The Top 2 Reasons To Look at Newly Built Homes

When planning a move, a newly built home might not be the first thing that comes to mind. But with more brand-new homes on the market and builders focusing on smaller, more affordable options, this type of home may just be the key to crossing the homebuying finish line.

Here’s why a new build is worth considering – and how an agent can help you find one that meets your needs and your budget.

1. More Newly Built Homes Are Available Right Now

First, let’s break down the types of homes on the market. A newly built home is a house that was just built or is under construction. On the other hand, an existing home is one a homeowner has already lived in.

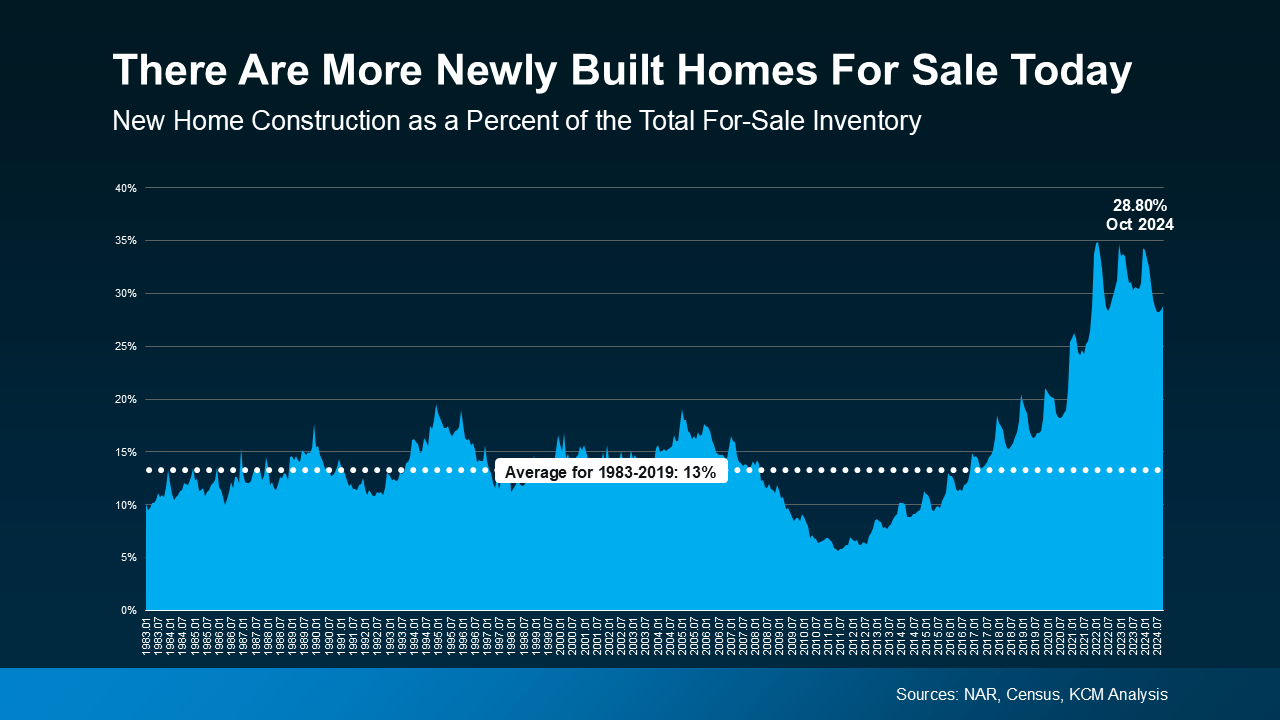

Right now, the number of existing homes for sale is still low. And, if you’re struggling to find something you like because there aren’t that many existing homes for sale, opening up your search to include brand-new homes could really expand your options. That’s because there are more newly built homes available right now than in a typical year (see graph below):

From 1983 to 2019, newly built homes made up only 13% of the total inventory of homes for sale. Today, that number has climbed to 28.8%, according to the most recent data.

From 1983 to 2019, newly built homes made up only 13% of the total inventory of homes for sale. Today, that number has climbed to 28.8%, according to the most recent data.

And as Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), notes:

“Even though existing home sales have been stuck at low levels, newly constructed home sales look to mark one of its best annual performance in 15 years . . . The new home inventory has been consistently rising with homebuilders getting active and making up around 1/3 of total inventory.”

While the uptick in new home construction is encouraging, rest assured that builders aren’t overdoing it, they’re just making up for over a decade of underbuilding. There are still way more buyers than there are homes on the market. But the good news for you is this increase in newly built homes means more options for your search.

2. Newly Built Homes Are Becoming Less Expensive

Still skeptical if a new build is right for you or if they’re even in your budget? The average cost of newly built homes has actually come down from a year ago.

Why is that? Builders know affordability is top of mind for homebuyers right now. So they’re focusing their efforts on building smaller homes they can offer at lower price points and are more likely to sell. As Realtor.com says:

“Builders are increasingly bringing smaller, more affordable homes to the market, so buyers may find more newly-built homes that fit their budget.”

Something to keep in mind: buying a newly built home isn’t the same as buying an existing one. Builder contracts have different fine print. So be sure to partner with a local agent who knows the market, builder reputations, and what to look for in those contracts.

Bottom Line

Depending on your needs and budget, a new build might be the opportunity you’ve been waiting for to bring your homebuying vision to life. If you’re interested in a brand-new home, connect with an agent so you can check out what builders in your area are up to.

Why Moving to a More Affordable Area Makes Sense

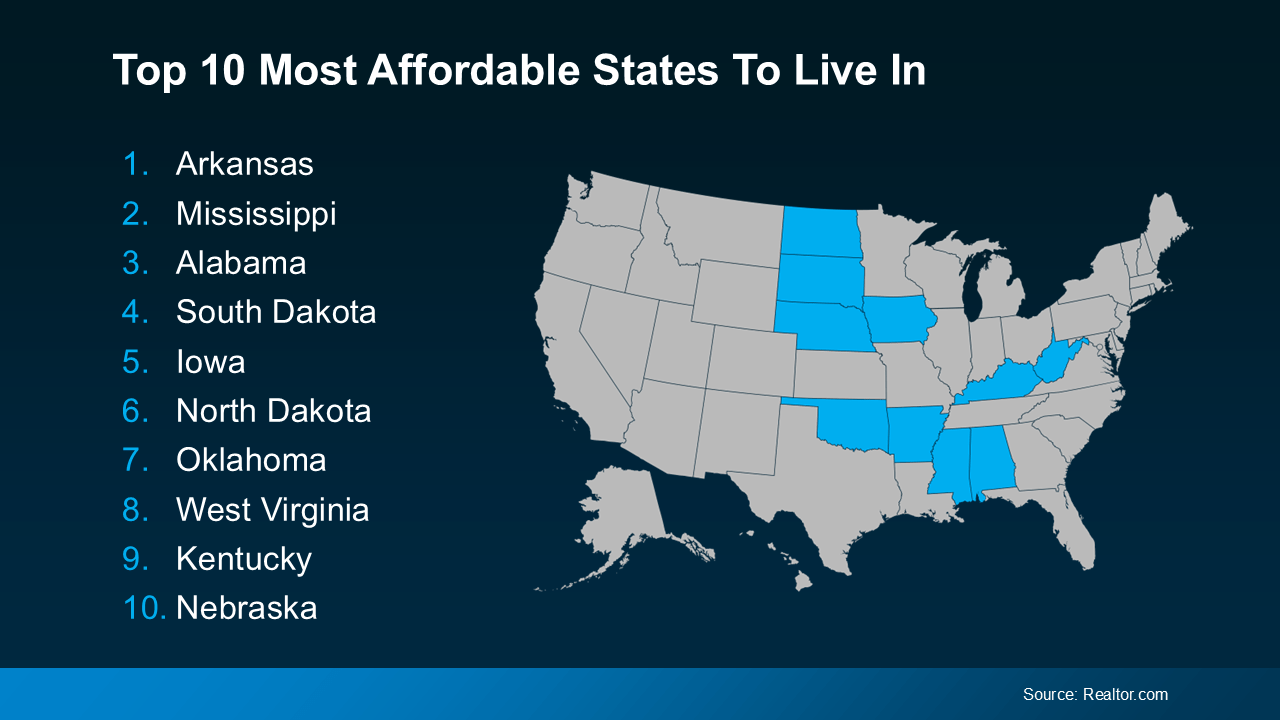

Moving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your desired location – no matter where you want to be – is always the best plan. And with the rising cost of living, many people are rethinking where they live and looking for ways to cut expenses. If that sounds like you, here’s a great place to start (see visual below):

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you’re open to relocating, you might discover the savings you’re looking for.

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you’re open to relocating, you might discover the savings you’re looking for.

Why Move to a Lower-Cost Area?

Life is getting more expensive by the day. From rising home prices to higher grocery bills, it feels like everything costs more than it used to. Housing, the largest expense for most people, has become especially costly.

In fact, according to data from Case-Shiller, home prices increased 3.9% from September 2023 to September 2024. And data from GOBankingRates shows insurance costs are up too, with home insurance premiums averaging $2,151 annually – a significant jump compared to recent years.

These rising costs can feel like a lot to handle. That’s why more people are considering lower-cost areas. An article from the National Association of Realtors (NAR) says:

“With the past decade of rising home prices, buyers are looking for more affordable areas . . . As housing affordability continues to shape migration patterns, these areas may provide an opportunity . . . for those looking for more cost-effective alternatives to the nation’s larger, pricier metropolitan areas.”

Lower-cost areas typically offer more affordable housing, less expensive home insurance, and reduced costs for daily living like groceries and gas. Transportation expenses and car insurance premiums also tend to be lower. For anyone feeling stretched thin, moving to a less expensive area can provide meaningful financial relief.

Planning Your Big Move

Whether it’s finding a home that fits your budget or cutting down on other expenses, making the right move in any market can bring significant financial relief. Of course, moving isn’t a decision to take lightly.

Whether you’re moving just a few towns over or to a completely different state, there’s a lot to consider. From job opportunities, to schools, to local amenities – it all has an impact on finding the right home for you.

This is where a knowledgeable local real estate agent can be your best resource. Not only can they help you navigate the housing market in your new or desired area, but they’ll also guide you to neighborhoods that balance affordability with your needs.

And don’t worry if none of the states on the affordability list seem like the right fit for you. An agent can still help you identify budget-friendly options wherever you need to be.

Bottom Line

If the rising cost of living has you feeling stuck, know that you have options. Moving to a more affordable area could be the fresh start you need to get ahead financially and improve your quality of life.

But don’t try to tackle the process alone. With the help of an agent who knows the area, you’ll be well-prepared to make a move. When you’re ready to take the first step, reach out to a local real estate agent.

Should You Sell Your House As-Is or Make Repairs?

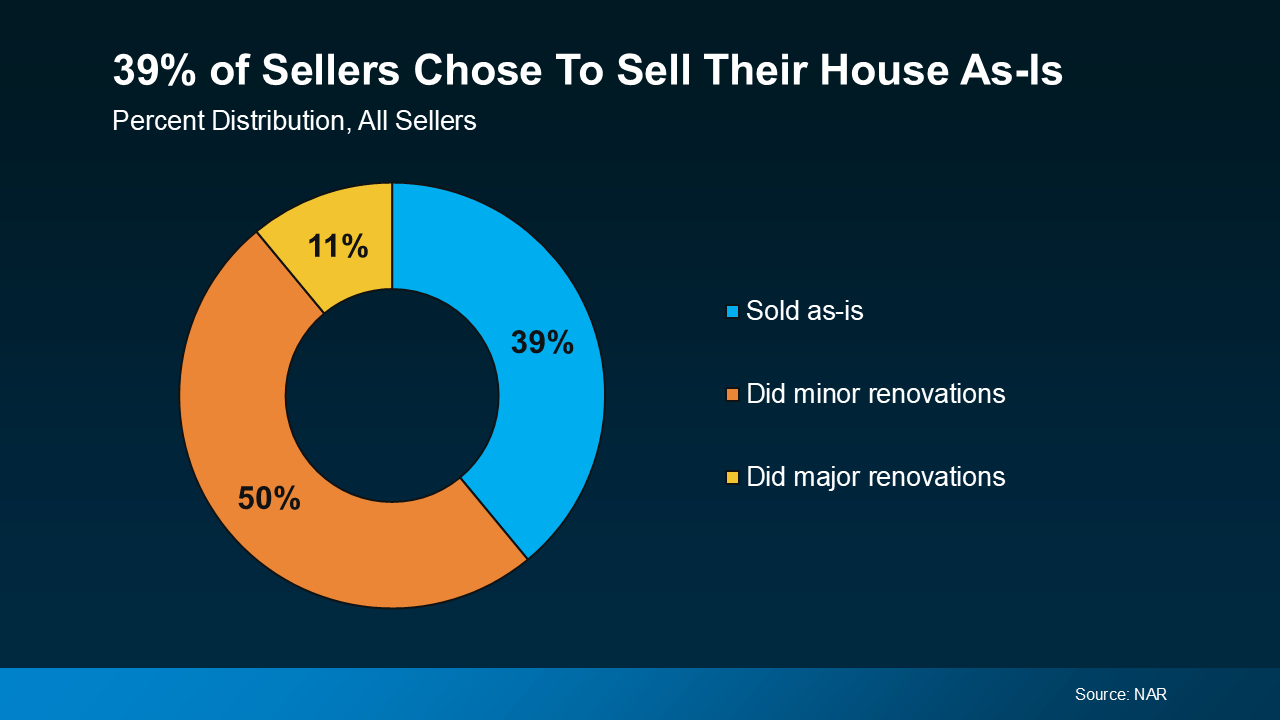

A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below):

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

What Does Selling As-Is Really Mean?

Selling as-is means you won’t make any repairs before the sale, and you won’t negotiate fixes after a buyer’s inspection. And this sends a signal to potential buyers that what they see is what they get.

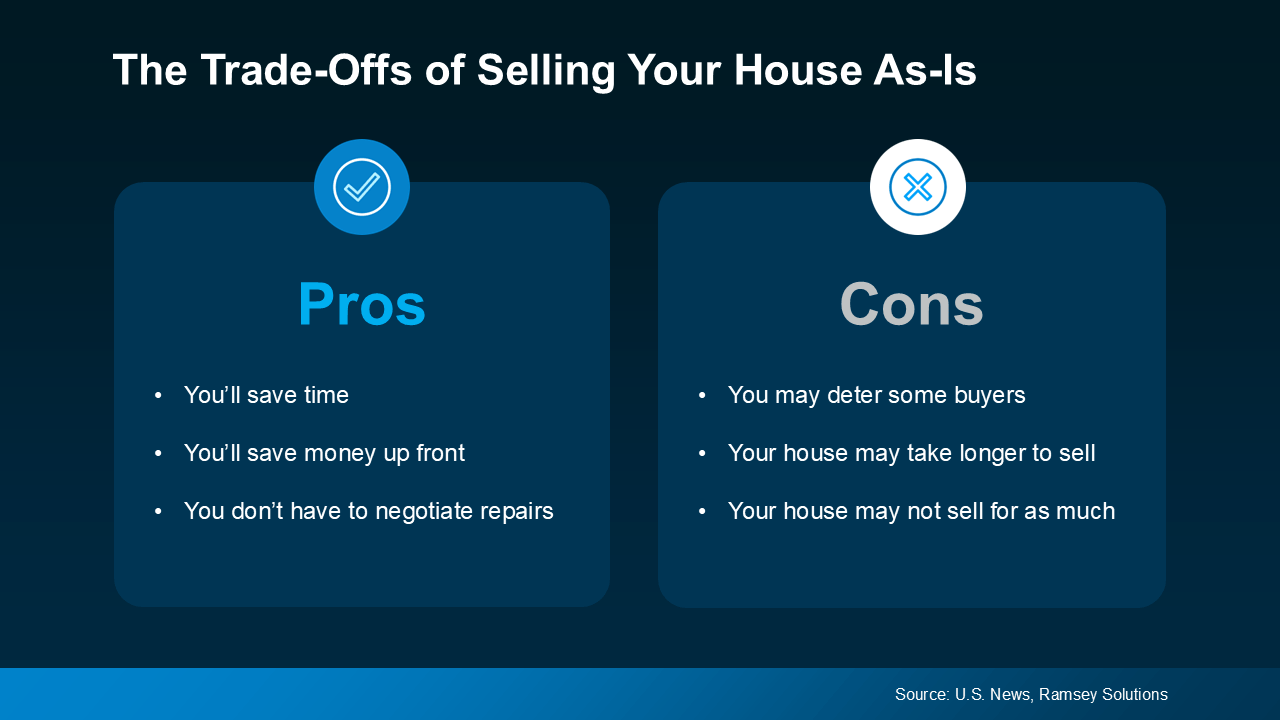

If you’re eager to sell but money or time is tight, this can be a relief because it’s that much less you’ll have to worry about. But there are a few trade-offs you’ll have to be willing to make. This visual breaks down some of the pros and cons:

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

That doesn’t mean your house won’t sell – it just means it may not sell for as much as it would in top condition.

Here’s the good news though. In today’s market, as many as 56% of buyers surveyed would be willing to buy a home that needs some work. That’s because affordability is still a challenge, and while there are more homes for sale right now, inventory is lower than the norm. So, you might find there are a few more buyers who may be willing to take on the work themselves.

How an Agent Can Help

So, how do you make sure you’re making the right decision for your move? The key is working with a pro.

A good agent will help you weigh your options by showing you what comparable homes in your area have sold for, what updates your neighbors are making, and guide you in setting a fair price no matter what you decide. That helps you anticipate what your house may sell for either way – and that can be a key factor in your final decision.

Once you’ve picked which route you’re going to go and the asking price is set, your agent will market your house to maximize its appeal. And if you decide to sell as-is, they’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just projects.

Bottom Line

Selling a home without making any repairs is possible in today’s market, but it does have some trade-offs. To make sure you’re considering all your options and making the best choice possible, have a conversation with a local agent.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

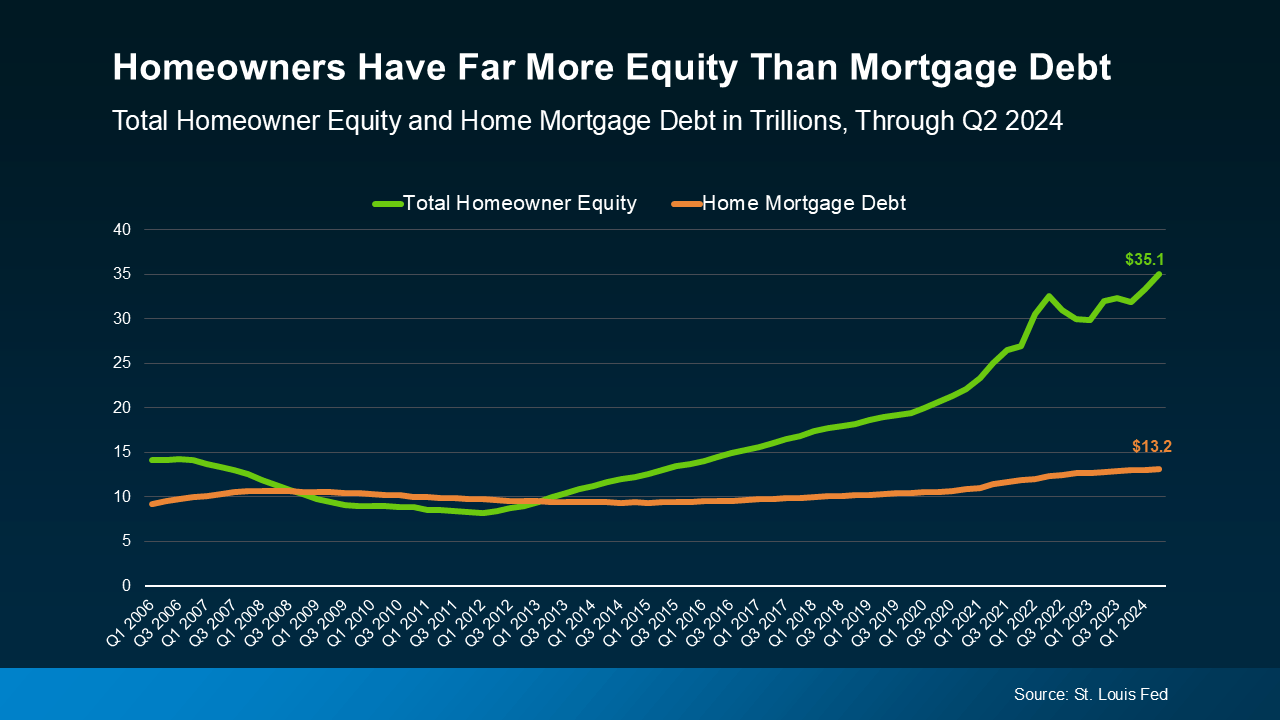

One major reason why we’re not heading toward a foreclosure crisis is the high level of equity homeowners have today. Unlike in the last housing bubble, where many homeowners owed more than their homes were worth, today’s homeowners have far more equity than debt.

That’s a big part of the reason why even though mortgage debt is at an all-time high, this isn’t 2008 all over again. As Bill McBride, Housing Analyst for Calculated Risk, explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Today’s homeowners are in a much stronger position than ever before. So, let’s break it down and see why today’s mortgage debt isn’t anything to fear.

More Equity, Less Risk of Foreclosures

According to the St. Louis Fed, total homeowner equity is nearly triple the total mortgage debt today (see graph below):

High equity makes it less likely for homeowners to face foreclosure because they have more options. If someone struggles to make their mortgage payments, they could potentially sell their house and still come out ahead thanks to their built-up equity.

High equity makes it less likely for homeowners to face foreclosure because they have more options. If someone struggles to make their mortgage payments, they could potentially sell their house and still come out ahead thanks to their built-up equity.

Even if home values were to dip, most homeowners would still have a comfortable cushion of equity. That’s a big contrast to the 2008 crisis, where many homeowners were underwater on their mortgages and had few options to avoid foreclosure.

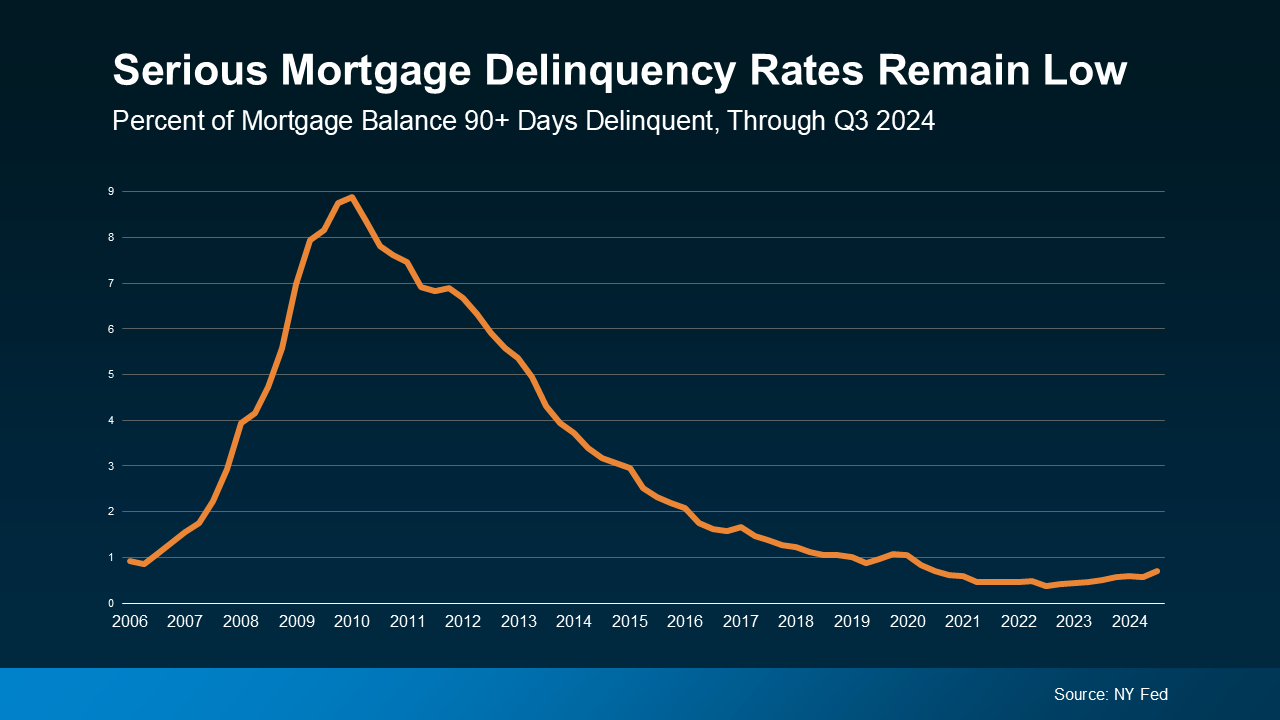

Delinquency Rates Are Still Near Historic Lows

Another reassuring sign is that, according to the NY Fed, the number of mortgage payments that are more than 90 days late is still near historic lows (see graph below):

This is partly due to a variety of programs designed to help homeowners through temporary hardships. As Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), says:

This is partly due to a variety of programs designed to help homeowners through temporary hardships. As Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), says:

“. . . servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

So, even if someone falls behind on their payments, there are support systems in place to help them avoid foreclosure.

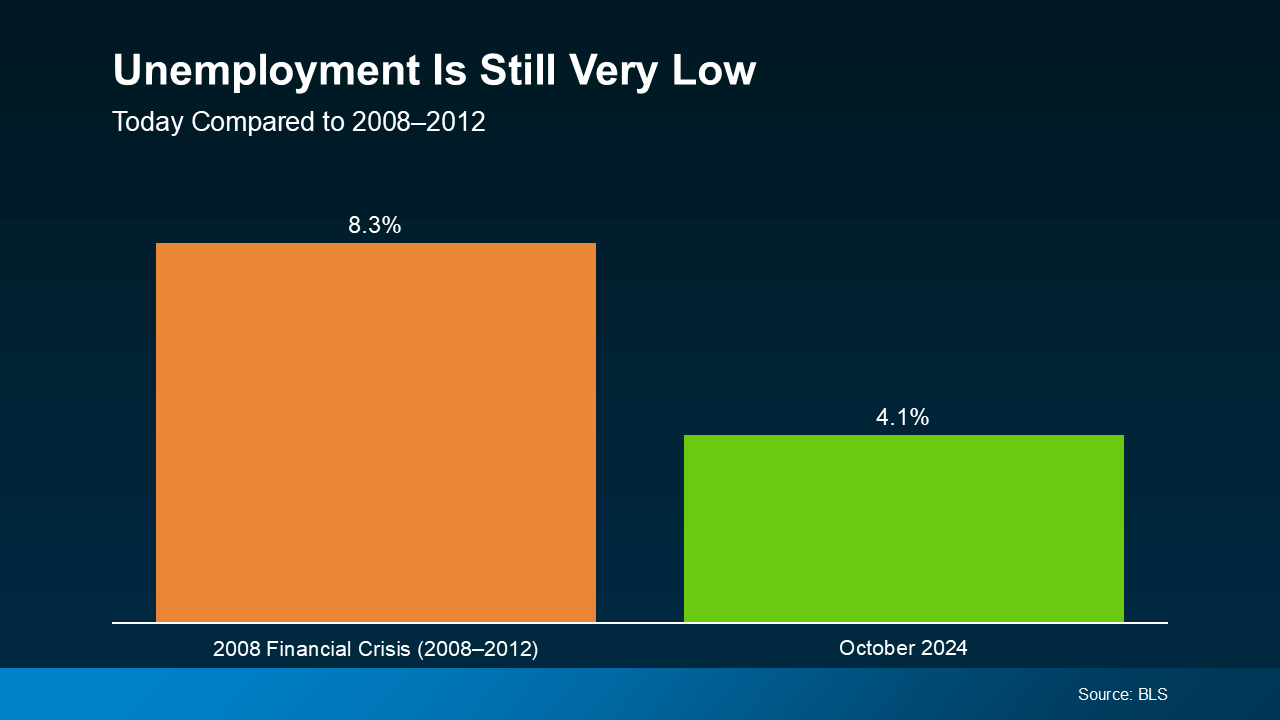

Low Unemployment Helps Keep the Market Stable

One other important factor is today’s low unemployment rate. More people have stable jobs, which means they’re better able to afford their mortgage payments. As Archana Pradhan, Principal Economist at CoreLogic, explains:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

During the last housing crisis, unemployment was much higher, which led to a wave of foreclosures. Today’s unemployment rate is very different (see graph below):

That stability in how many people are employed is one of the reasons the market doesn’t have the same risks as it did the last time.

That stability in how many people are employed is one of the reasons the market doesn’t have the same risks as it did the last time.

There’s no need to worry about a wave of distressed sales like the one we saw in 2008. Most homeowners today are employed and have low-interest mortgages they can afford, so they’re able to make their payments. As McBride states:

“The bottom line is there will not be a huge wave of distressed sales as happened following the housing bubble.”

Bottom Line

While mortgage debt is high, rest assured the market isn’t on the brink of another crash. Instead, most homeowners are in a strong position. If you have questions or concerns, connect with a local real estate agent.

How To Get Your House Ready To Sell in 2025

Some Highlights

- If you’re planning to list your house in 2025, it’s already time to start working on any repairs. But where do you start?

- Your local agent will be able to help you prioritize projects that will help you get the best return on your investment and appeal to what today’s buyers really want.

- If your goal is to sell your house next year, connect with an agent so you know what to start working on now.

What’s Behind Today’s Mortgage Rate Volatility?

If you’ve been keeping an eye on mortgage rates lately, you might feel like you’re on a roller coaster ride. One day rates are up; the next they dip down a bit. So, what’s driving this constant change? Let’s dive into just a few of the major reasons why we’re seeing so much volatility, and what it means for you.

The Market’s Reaction to the Election

A significant factor causing fluctuations in mortgage rates is the general reaction to the political landscape. Election seasons often bring uncertainty to financial markets, and this one is no different. Markets tend to respond not only to who won, but also to the economic policies they are expected to implement. And when it comes to what’s been happening with mortgage rates over the past couple of weeks, as the National Association of Home Builders (NAHB) says:

“. . . the primary reason interest rates have been on the rise pertains to the uncertainty surrounding the presidential election. Although the election is now complete, there continue to be growing concerns over budget deficits.”

In the short term, this anticipation has caused a slight uptick in mortgage rates as the markets adjust and react. Additionally, factors like international tensions, supply chain disruptions, and trade policies can drive investor sentiment, causing them to seek safer assets like bonds, which can indirectly impact mortgage rates. Essentially, the more global or domestic uncertainty, the greater the chance that mortgage rates may shift.

The Economy and the Federal Reserve

Inflation and unemployment are two other big drivers of mortgage rates. The Federal Reserve (the Fed) has been working to bring inflation under control, and has been closely monitoring the economy as they do. And as long as inflation continues to moderate and the job market shows signs of maximum employment, the Fed will continue its plans to cut the Federal Funds Rate.

Although the Fed doesn’t set mortgage rates, their decisions do have an impact, and typically a cut leads to a mortgage rates response. And in their November 6-7th meeting, the Fed had the data they needed to make another cut to the Federal Funds Rate. And while that decision was expected and much of the mortgage rate movement happened prior to that meeting, there was a slight dip in rates.

What To Expect in the Coming Months

As we look ahead, mortgage rates will respond to changes in the Fed’s policies and other economic indicators. The markets will likely remain in a wait-and-see mode, reacting to each new development. And, with the transition of a new administration comes an element of unpredictability. A recent article from The Mortgage Reports explains:

“Today’s economic indicators come with mixed pressures on mortgage rates and we’re likely to be in for a good amount of volatility as markets adjust and respond to the election . . .”

The best way to navigate this landscape is to have a team of real estate experts by your side. Professionals will help you understand what’s happening and can provide you with the guidance you need to make informed housing market decisions along the way.

Bottom Line

The takeaway? Today’s mortgage rate volatility is going to continue to be driven by economic factors and political changes.

Now is the time to lean on experienced professionals. A trusted real estate agent and mortgage lender can help you navigate through it. And with the right guidance, you can make informed decisions.

Is Wall Street Really Buying All the Homes?

Let’s be real – buying a home right now is tough. You’re scrolling through listings, rushing to open houses, and maybe even losing out to more competitive offers. Somewhere along the way, you might’ve heard the reason it’s so hard to find a home is because big Wall Street investors are swooping in and snatching up everything in sight.

But here’s the thing: that’s mostly a myth. While investors are part of the market, according to Redfin, they’re a relatively small part:

Here’s what that means. Five out of every six homes are being purchased by everyday homebuyers like you – not big investors.

Here’s what that means. Five out of every six homes are being purchased by everyday homebuyers like you – not big investors.

So, before you get discouraged, let’s take a look at what’s really going on. You might be surprised to learn that Wall Street isn’t the competition you may think it is.

Most Investors Are Small Mom-and-Pops

Most investors aren’t the mega corporations you’ve probably heard about. In fact, many are your neighbors. A recent report from CoreLogic shows most investors are small, mom-and-pop types who own fewer than 10 properties. They aren’t massive companies with endless resources. Picture your neighbor who has another home they’re renting out or a vacation getaway.

Only about 1% of the market is owned by large, mega investors with thousands of properties. The majority are still owned by individuals and smaller investors – not the Wall Street giants.

Investor Purchases Are Declining

Not only are most investors small, but overall investor purchases have been on the decline. As the same report from CoreLogic says:

“Investors made 80,000 purchases in June 2024, compared with 112,000 in June 2023, and a nearly 50% percent drop from the high of 149,000 purchases in June 2021 . . .”

And what does this mean going forward? CoreLogic goes on to point out this downward trend is expected to continue into 2025.

So, if it seems like competition with investors is pushing you out of the market, it might help to know that investor activity is actually slowing down.

Bottom Line

The idea that Wall Street is buying up all the homes is largely a myth. Most investors are small ones, and the share of homes purchased by investors is declining – so you can take this one off your worry list.

If you have questions about the housing market, talk to a local real estate agent. They can explain what’s really happening.

Should You Sell Your House or Rent It Out?

When you’re ready to move, figuring out what to do with your house is a big decision. And today, more homeowners are considering renting their home instead of selling it.

Recent data from Zillow shows about two-thirds (66%) of sellers thought about renting their home before listing, with nearly a third (28%) taking that possibility seriously. Compared to 2021, when fewer than half (47%) of homeowners considered renting before selling, it’s clear this trend is on the rise.

So, should you sell your house and use the money toward your next home or keep it as a rental to build long-term wealth? Let’s walk through some important questions to help you determine the right path for your financial and lifestyle goals.

Is Your House a Good Fit for Renting?

Before you decide what to do, it’s important to think about if it would make a good rental in the first place. For instance, if you’re moving far away, managing ongoing maintenance could become a major hassle. Other factors to consider are if your neighborhood is ideal for rentals and if your house needs significant repairs before it’s ready for tenants.

If any of these situations sound familiar, selling might be a more practical choice.

Are You Ready for the Realities of Being a Landlord?

Managing a rental property involves more than collecting monthly rent. It’s a commitment that can be time-consuming and challenging.

For example, you may get maintenance calls at all hours of the day or discover damage that needs to be repaired before a new tenant moves in. There’s also the risk of tenants missing payments or breaking their lease, which can add unexpected stress and financial strain. As Redfin notes:

“Landlords have to fix things like broken pipes, defunct HVAC systems, and structural damage, among other essential repairs. If you don’t have a few thousand dollars on hand to take care of these repairs, you could end up in a bind.”

Do You Understand the Costs?

If you’re considering renting primarily for passive income, remember, there are additional costs you should anticipate. As an article from Bankrate explains:

Mortgage and Property Taxes: You still need to pay these expenses, even if the rent doesn’t cover all of it.

Insurance: Landlord insurance typically costs about 25% more than regular home insurance, and it’s necessary to cover damages and injuries.

Maintenance and Repairs: Plan to spend at least 1% of the home’s value annually, more if the house is older.

Finding a Tenant: This involves advertising costs and potentially paying for background checks.

Vacancies: If the property sits empty between tenants, you’ll lose rental income and have to cover the cost of the mortgage until you find a new tenant.

Management and HOA Fees: A property manager can ease the burden, but typically charges about 10% of the rent. HOA fees are an additional cost too, if applicable.

Bottom Line

To sum it all up, selling or renting out your home is a personal decision. Make sure to weigh the pros and cons carefully and consult with professionals so you feel supported and informed as you make your decision. A real estate agent can be a great person to go to for advice.

More Homes, Slower Price Growth – What It Means for You as a Buyer

There are more homes on the market right now than there have been in years – and that could be a game changer for you if you’re ready to buy. Let’s look at two reasons why.

You Have More Options To Choose From

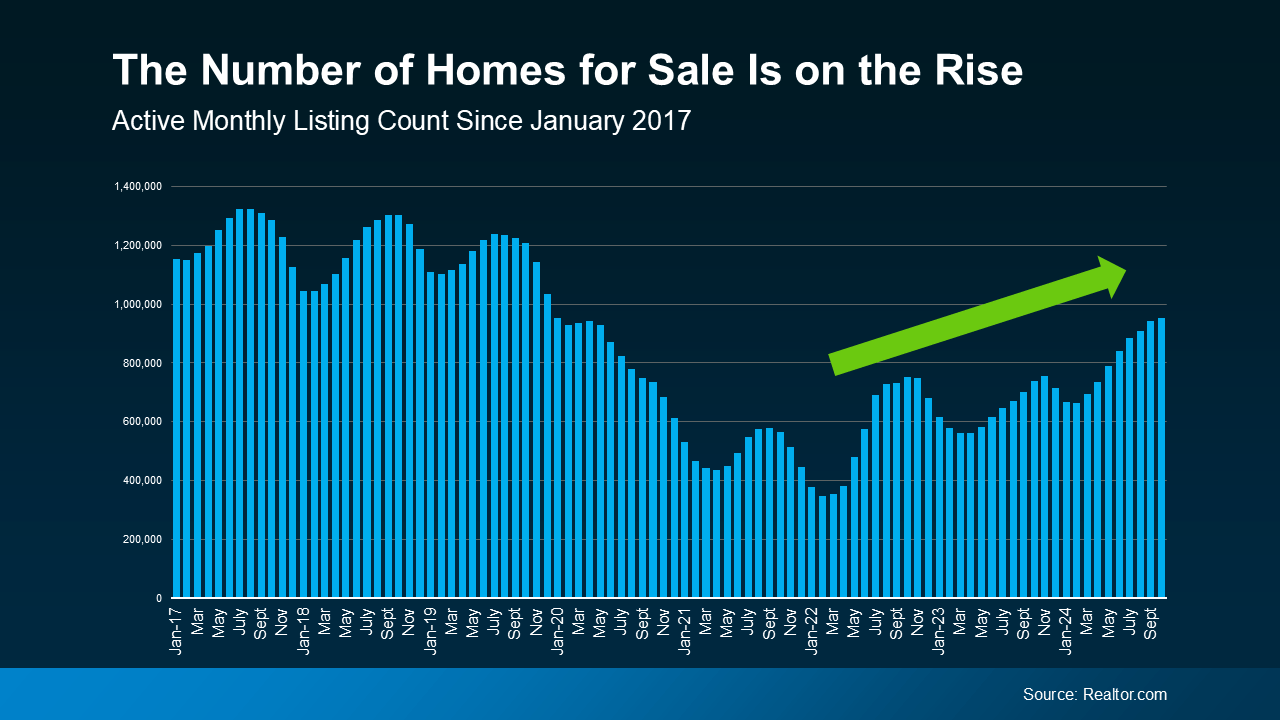

An article from Realtor.com helps explain just how much the number of homes for sale has gone up this year:

“There were 29.2% more homes actively for sale on a typical day in October compared with the same time in 2023, marking the twelfth consecutive month of annual inventory growth and the highest count since December 2019.”

And while the number of homes on the market still isn’t quite back to where it was in the years leading up to the pandemic, this is definitely an improvement (see graph below):

With more homes available for sale now, you have more options to choose from. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

With more homes available for sale now, you have more options to choose from. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

“Though still lower than pre-pandemic, burgeoning home supply means buyers have more options . . .”

That means you have a better chance of finding a house that meets your needs. It also means the buying process doesn’t have to feel quite as rushed, because more options on the market means you’ll likely face less competition from other buyers.

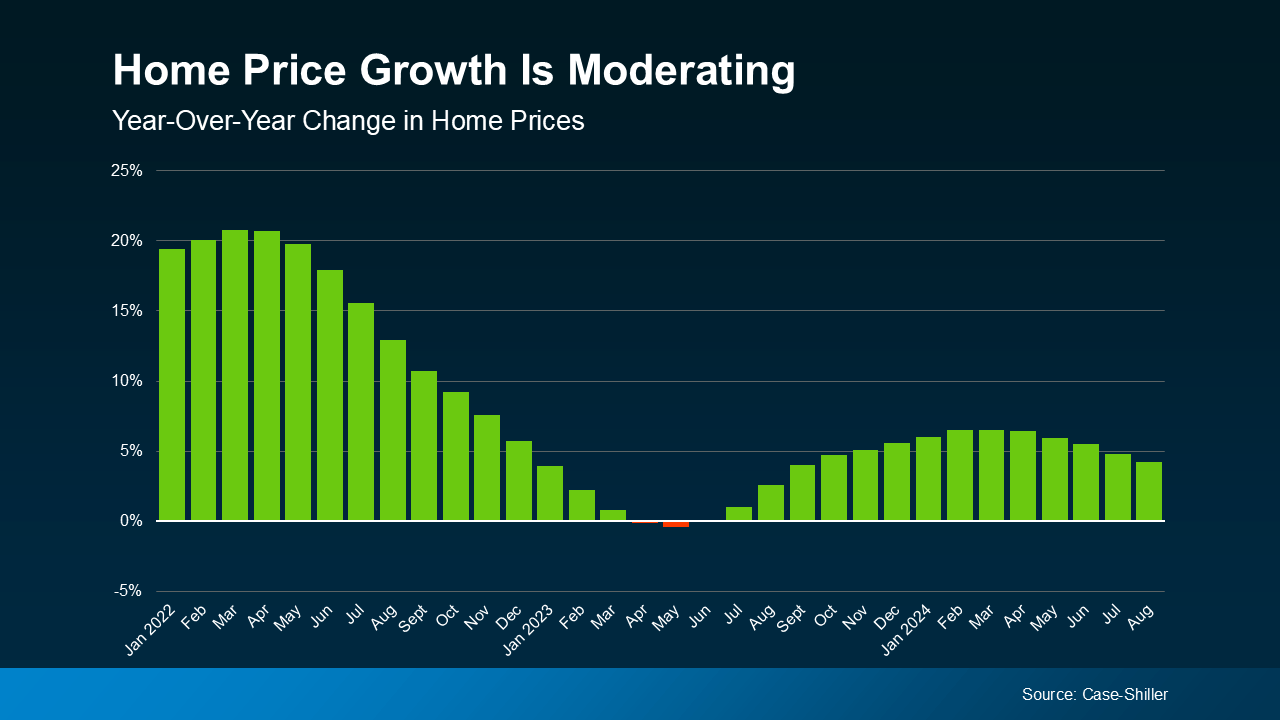

Home Price Growth Is Slowing

When there aren’t many homes for sale, buyers have to compete more fiercely for the ones that are available. That’s what happened a few years ago, and it’s what drove prices up so quickly.

But now, the increasing number of homes on the market is causing home price growth to slow down (see graph below):

In certain markets, the number of available homes has not only bounced back to normal, but has even surpassed pre-pandemic levels. In those areas, home price growth has slowed or stalled completely. As Lance Lambert, Co-Founder of ResiClub, explains:

In certain markets, the number of available homes has not only bounced back to normal, but has even surpassed pre-pandemic levels. In those areas, home price growth has slowed or stalled completely. As Lance Lambert, Co-Founder of ResiClub, explains:

“Generally speaking, housing markets where active inventory has returned to pre-pandemic 2019 levels have seen home price growth soften or even decline outright from their 2022 peak.”

Slower or stalled price growth could give you a better chance of finding something within your budget. As Dr. Anju Vajja, Deputy Director at the Federal Housing Finance Agency (FHFA), says:

“For the third consecutive month U.S. house prices showed little movement . . . relatively flat house prices may improve housing affordability.”

But remember, inventory levels and home prices are going to vary by market.

So, having a real estate agent who knows the local area can be a big advantage. They can help you understand the trends in your community, which can make a real difference in finding a home that fits your needs and budget.

Bottom Line

More housing options – and the slower home price growth they bring – can help you find and buy a home that works for your lifestyle and budget. So don’t hesitate to reach out to a local real estate agent if you want to talk about the growing number of choices you have right now.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

You’ve probably noticed one thing if you’re thinking about making a move: the housing market feels a bit unpredictable right now. The truth is, from home prices to mortgage rates, we’re seeing more volatility – and it’s important to understand why.

At a high-level, let’s break down what’s happening and the best way to navigate it.

What’s Driving Today’s Market Volatility?

Factors like economic data, unemployment numbers, decisions coming out of the Federal Reserve (The Fed), and even the presidential election, are creating uncertainty right now – and uncertainty leads to market volatility.

You can see that when you look at what’s happening with mortgage rates. New economic reports and other geopolitical events have an impact and can cause sudden shifts up or down, even though experts still forecast rates will come down overall. We’ve seen that effect play out recently, like when employment and inflation data get released each month.

And as the markets react, these types of updates will continue to have an impact on rates moving forward. As Greg McBride, CFA, Chief Financial Analyst at Bankrate, says:

“After steadily declining throughout the summer months, I expect more ups and downs to mortgage rates . . . Job market data will be closely watched as well as any clues from the Fed about the extent of upcoming interest rate cuts.”

This is exactly why the projected decline in mortgage rates isn’t going to be a straight line down over the next year. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

“Rates have shown considerable volatility lately, and may continue to do so . . . Overall, we still expect a downward long-term mortgage rate trend.”

Plus, home prices and the number of homes on the market vary dramatically depending on where you’re looking to buy or sell, which makes it even harder to get a clear picture. In some areas, home prices are rising and inventory is tight, while in others, there are more homes available and it’s leading to more moderate pricing shifts.

As all of this unfolds, understanding what’s happening will help you make the right decisions, whether that’s buying or selling. And there’s one easy way to get that information: from a professional.

The Importance of Partnering with a Pro

While the road ahead may have some bumps and unexpected turns, you don’t have to go it alone. A great agent will keep you up to date on the latest market developments, guide you through any shifts, and help you make smart decisions based on your goals.

For example, as mortgage rates change, professionals (like your agent and a trusted lender) will explain how the shifts impact what you can reasonably plan for in your monthly payment. This will help you see how even a small change in rates can impact your bottom line – that way you don’t lose sight of the big picture even as shifts happen here and there.

And since conditions can vary significantly from one neighborhood to another, your agent will also help you understand the specifics of your market—whether it’s how to navigate competition with other buyers, the number of homes available, or what’s happening with local home prices. Their insights and expertise will help you adapt to any movement in the market.

Bottom Line

The housing market may be experiencing some shifts, but don’t let it stop you from making your move. With the support of an experienced real estate agent and a trusted lender, you’ll be ready to navigate the changes and make the most of the opportunities that come your way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link