The #1 Thing Sellers Need To Know About Their Asking Price

When you put your house on the market, you want to sell it quickly and for the best price possible; that’s generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.

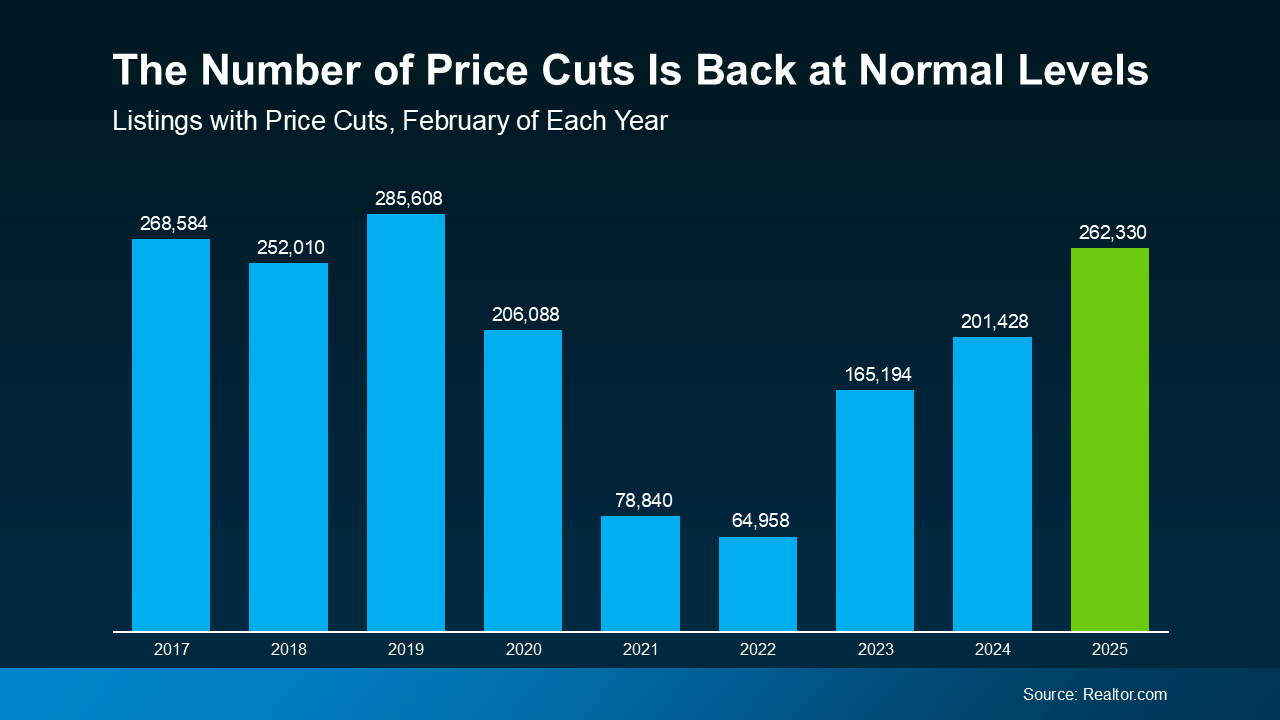

According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):

If you consider that 2019 was the last true normal year for the housing market – that’s a big deal. We’re getting back to what’s typical for the market.

This isn’t the same frenzied seller’s market we saw a few years ago. You may not get the same price your neighbor did at the height of the pandemic. And that means you may need to reset your expectations.

Because here’s the reality. If you shoot too high and have to lower your price after the fact, you could actually end up walking away with lower offers than if you’d priced it right from the start. So, how do you avoid that? You lean on your agent.

How an Agent Helps You Nail the Right Price

A great agent doesn’t just pull a number out of thin air. They’ll use real data and market trends to make sure your house is priced based on what your specific home is valued at today. So, you’re setting a realistic price – one that’ll draw in serious buyers.

And based on your agent’s analysis of your local market, they may even recommend strategically pricing slightly below market value to help your house attract more eyes and more competitive offers. Here’s how your agent will determine the right number for your house:

- They look at recent sales. What did similar homes in your area actually sell for? Not list for, sell for.

- They analyze local market trends. Your home’s value isn’t just about what you want for it, it’s about what buyers in your area are willing to pay.

- They craft the right strategy. They’ll make sure your home is priced to attract attention and create a sense of urgency among buyers.

Why Overpricing Backfires

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may not even look at it. Today’s buyers are more budget-conscious than ever. If they see a home that seems overpriced, they’re likely to skip it completely rather than try to negotiate.

- It could sit on the market for too long. The longer your home sits unsold, the more buyers will assume something’s wrong with it. That can make it even harder to sell down the line.

- You might end up getting less. Homes that require a price cut often sell for less than they would have if they had been priced right from the start.

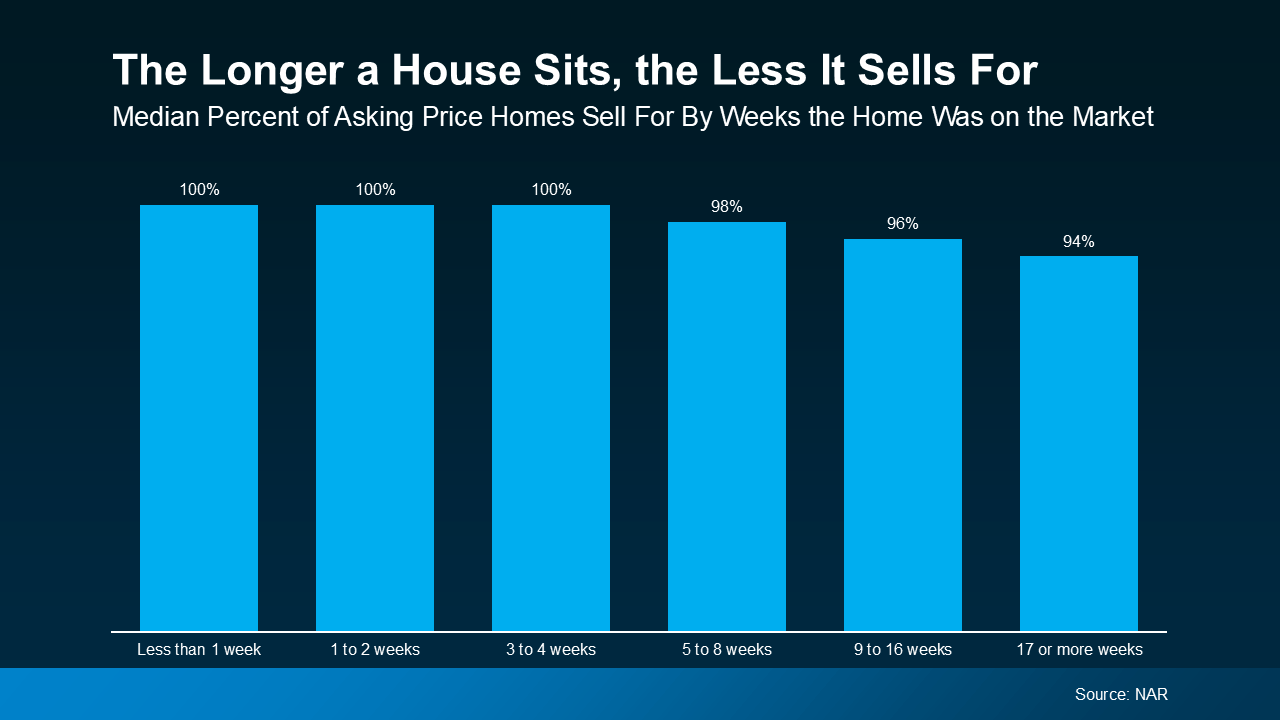

You can see that shake out in the graph below. It uses data from the National Association of Realtors (NAR) to show that the longer a house sits, the less it’ll sell for:

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that’s what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that’s what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

But if a house isn’t priced right, it doesn’t sell as quickly. And this graph shows that, after the first 4 weeks on the market, the price starts to drop from there. That’s because buyer interest falls off the longer it sits. So, it becomes more likely a seller will either accept a lower offer because that’s all they have, or opt to do a price drop to draw people back in.

Bottom Line

The last thing you want is to list too high, watch your house sit, and then have to drop the price just to get attention. Talk to a local agent so that doesn’t happen to you.

Want to make sure your home sells quickly and for the best price? Connect with an agent to talk about the right pricing strategy for your house.

Townhomes: A Smart Solution for Today’s First-Time Buyers

Buying your first home in today’s market can feel tough. Between high home prices and mortgage rates, affordability is still a big challenge. And some buyers are making one simple trade-off that’s getting them in the door faster: square footage.

According to the National Association of Home Builders (NAHB), 35% of buyers are willing to purchase something smaller to make homeownership happen. And one place you can usually find a smaller footprint (and sometimes better affordability) is in townhomes.

Why Townhomes Are Gaining Popularity

Townhomes typically cost less than single-family homes due to their more limited size. And that’s a big plus for today’s budget-conscious buyer. As Realtor.com says:

“In today’s market, affordability remains a key priority for homebuyers, making townhomes an attractive option because they are often priced more reasonably than single-family homes. It makes them especially appealing to first-time homebuyers on a tighter budget . . .”

So, if you’re trying to buy but feeling stuck because of rising prices, shifting your focus to townhomes could be one way to get into homeownership without maxing out your budget.

Builders Are Responding to the Demand

Builders have seen buyers’ appetite shift to smaller homes, and they’re adjusting to meet the demand. As Joel Berner, Senior Economist at Realtor.com, explains:

“Builders are making a concerted effort to provide smaller, more affordable inventory to the market in a way that the existing-home market cannot. Townhomes are a significant portion of that effort.”

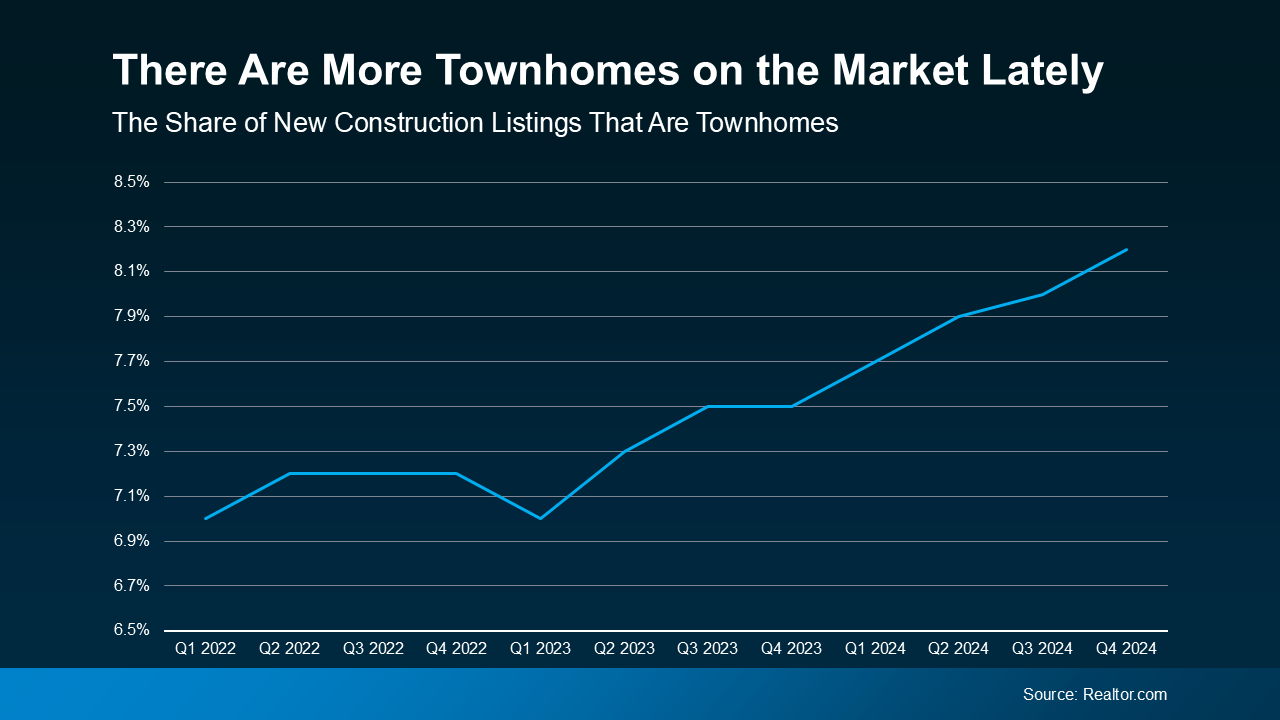

And the numbers back it up. According to data from Realtor.com, townhomes now make up a bigger share of new construction listings than they did just a couple of years ago (see graph below):

That means, if you’re interested in this type of house, you have more choices than you would have had over the last few years. And more options that are potentially more affordable are definitely a good thing. It should make your search for your first home a bit easier.

That means, if you’re interested in this type of house, you have more choices than you would have had over the last few years. And more options that are potentially more affordable are definitely a good thing. It should make your search for your first home a bit easier.

Is a Townhome Right for You?

If you’ve been focused only on more traditional homes with their own yards, an agent can help you explore whether a townhome could work for you. Who knows, you may find out you love the lifestyle. A lot of people do. As an article from the National Association of Realtors (NAR) explains:

“Townhomes tend to cost less than single-family detached homes and can be appealing to young professionals who may desire medium-density, walkable neighborhoods.”

That’s because they’re lower maintenance, they can provide a sense of community with other residents, and they have their own unique amenities. Not to mention, they give you the chance to start building wealth through homeownership without the upkeep that comes with having your own detached, single-family home. And that can be great for first-time buyers who are a bit worried about the maintenance anyway.

But they also come with some other considerations, like dealing with noise through shared walls. If you’re a renter right now, maybe you’re used to that already. But these are the types of things you’ll want to think about. And that’s where an agent’s expertise comes in. They’ll help you weigh the pros and cons, so you understand how a townhome fits into your lifestyle and long-term goals before making your decision.

Bottom Line

If you’re struggling to find a home within your budget, it may be time to expand your search and consider options you haven’t before, like townhomes. Sometimes, compromising a little bit on space is worth it to get your foot in the door.

What matters most to you — space, location, or budget? Connect with an agent to figure out where you can flex to make homeownership happen.

Here’s What a Recession Could Mean for the Housing Market

Recession talk is all over the news, and the odds of a recession are rising this year. And that leaves people wondering what would happen to the housing market if we do go into a recession.

Let’s take a look at some historical data to show what’s happened in housing for each recession going all the way back to the 1980s.

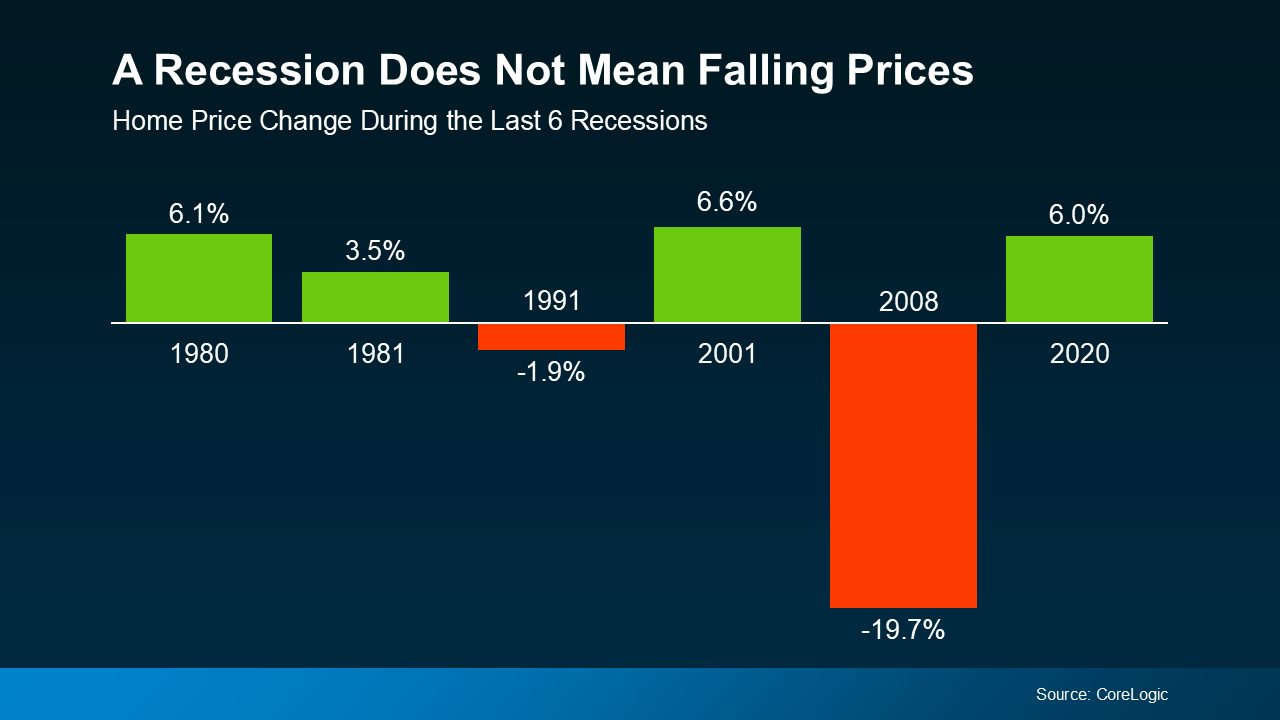

A Recession Doesn’t Mean Home Prices Will Fall

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time we saw such a steep drop in prices. And it hasn’t happened since.

In fact, according to data from CoreLogic, in four of the last six recessions, home prices actually went up (see graph below):

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

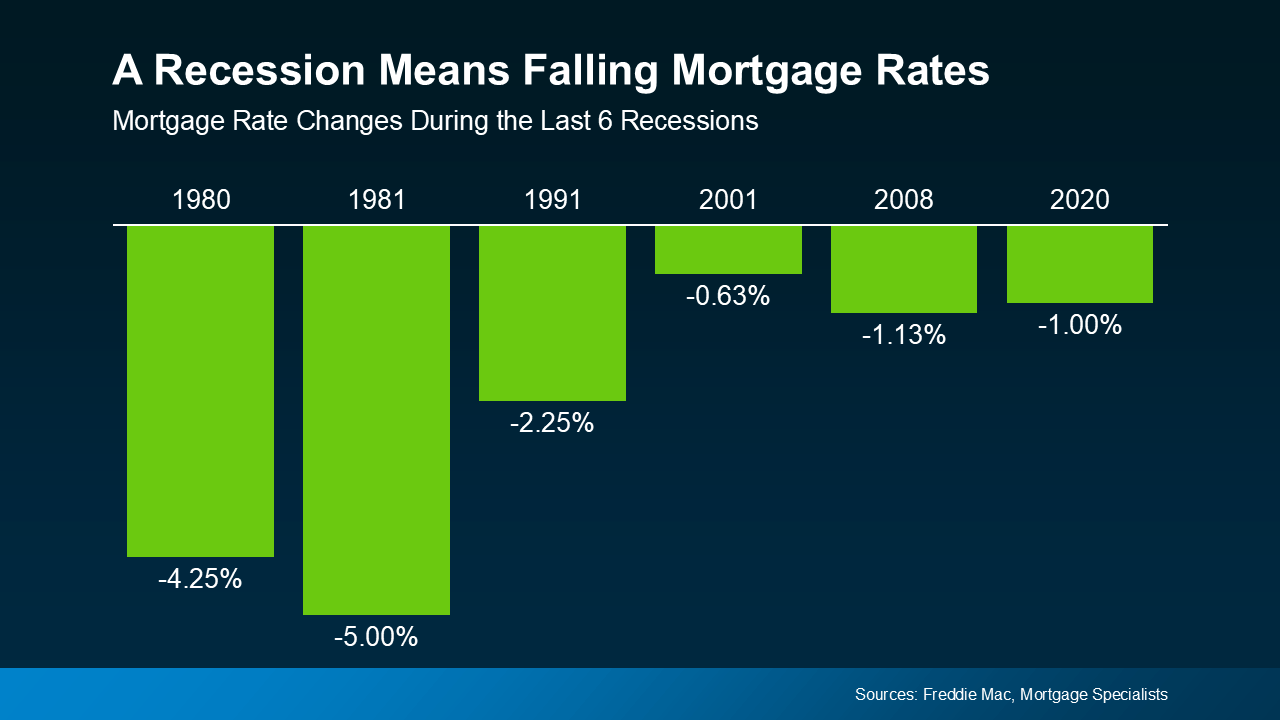

Mortgage Rates Typically Decline During Recessions

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

Bottom Line

The answer to the recession question is still unknown, but the odds have gone up. But that doesn’t mean you have to wonder about the impact on the housing market – historical data tells us what usually happens.

When you hear talk about a possible recession, what concerns or questions come to mind about buying or selling a home?

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

Last year, 70% of buyers abandoned their home search – and maybe you were one of them. It makes sense. Inventory was low, prices were high, and mortgage rates were up and down like a rollercoaster. All of that made it really hard to find a home you loved – and could afford.

But guess what? The market is shifting.

So, if you paused your moving plans in 2024, it might be time to hit play again. Here’s why.

More Inventory Opens Up More Options

Even if you could make the numbers work, the lack of available homes in recent years probably made it hard to come by something that fit your needs. But inventory is rising, which means you have more options now.

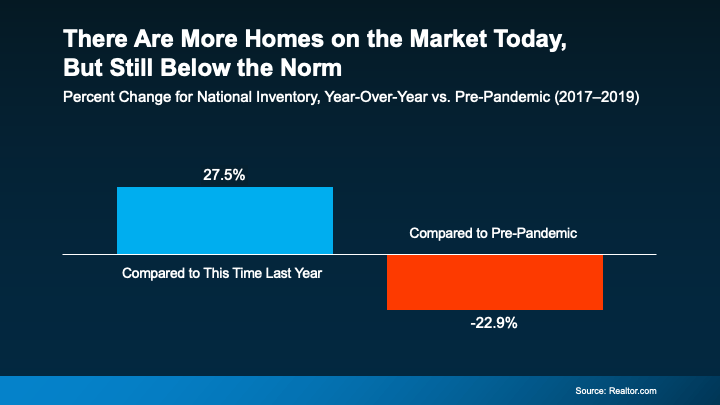

According to Realtor.com, inventory has jumped 27.5% since this time last year (see graph below):

So, if you were reluctant to list your house because you weren’t sure where you’d go if it sold, you have more choices than you did a year ago. That’s a big win.

So, if you were reluctant to list your house because you weren’t sure where you’d go if it sold, you have more choices than you did a year ago. That’s a big win.

Homes Are Staying on the Market Longer, Too

When the supply of homes for sale is low, they’re snatched up quickly because there just aren’t enough of them to go around. And a few years ago, that meant your house could sell overnight. While that’s not always a bad thing, if you’re planning a move and also need to find your next home, a slower pace isn’t the end of the world. In fact, it’s welcome relief.

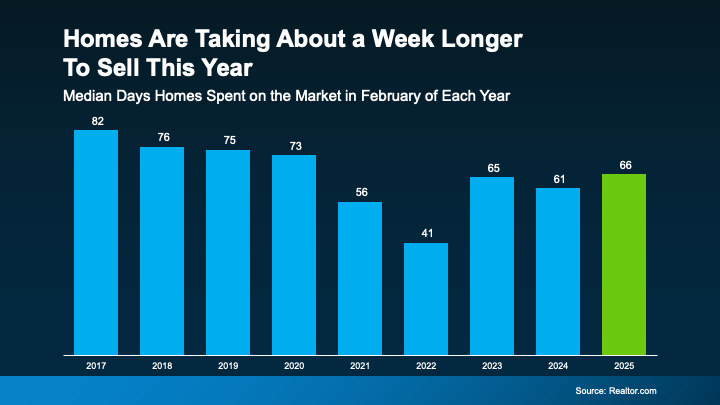

Now that inventory has grown, homes are staying on the market longer, meaning you don’t have to feel as rushed in the process (see graph below):

The latest data shows the typical time homes spent on the market went up by about 8% this year – that’s higher than we’ve seen since 2020, but still a faster pace than before the market ramped up. And it’s about a week longer than last year. Talk about a sweet spot for movers. It may seem like just a few days, but it gives you more flexibility and time to be thoughtful about your decisions. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, notes:

The latest data shows the typical time homes spent on the market went up by about 8% this year – that’s higher than we’ve seen since 2020, but still a faster pace than before the market ramped up. And it’s about a week longer than last year. Talk about a sweet spot for movers. It may seem like just a few days, but it gives you more flexibility and time to be thoughtful about your decisions. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, notes:

“There are more homes for sale than in the last few years, which means the market pace is a bit more manageable–with longer days on market–and many sellers are more flexible . . . Though buyers face still-high housing costs, they may find a bit more give in the market, which could give them more time to make a decision, even in the busy spring and summer months.”

And if you’re thinking – but wait – doesn’t that mean it will be harder to sell my house? Don’t worry. With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling, especially as more buyers step back into the game this season.

Bottom Line

With growing inventory, sellers who want to upgrade, downsize, or relocate have more choices. Plus, with less pressure to rush into an offer, it could be a great time to revisit your home search if you put it on hold.

With more homes on the market and more time to make decisions, what else do you need to see in order to kickstart your home search again?

National Housing Trends To Watch

Some Highlights

- At a national level, the housing market has shifted over the past year.

- There are more homes for sale, price growth has moderated, and homes are taking a little longer to sell.

- Do you want to know how your area compares? Connect with a real estate agent to go over what’s happening locally and what this means for you.

Buyers Have More Negotiation Power – Here’s How To Use It

You may have heard there are more homes for sale right now. And while that’ll vary depending on the market, it means that overall, things are starting to lean in a more balanced direction. As that happens, some sellers are a bit more open to compromise. Here’s what that means for you.

You may be regaining some negotiating power. That can translate into savings, perks, or even better terms on your purchase – if you know what levers to pull during negotiation.

Why an Agent Is an Essential Part of the Negotiation Process

The complicated part is knowing what is and isn’t on the table. That’s where your agent comes in. According to the National Association of Realtors (NAR), besides finding the right home, the top thing buyers want from their agent is help negotiating the terms of the sale, followed by negotiating the price.

Here’s why. Agents are skilled negotiators and are trained for moments like this. Since your agent is an expert on the local market, they’ll also know what’s working for other buyers (and what’s not), and that can help you get a better understanding of what’s realistic to ask for.

What’s on the Negotiation Table?

Here are some of the most common concessions an agent can help you negotiate:

- Sale Price: The most obvious concession is the price of the home. And that lever is being pulled more often today. Buyers don’t want to overpay when affordability is already so tight. And sellers who aren’t realistic about their asking price may have to consider adjusting their price.

- Closing Costs: Closing costs are usually about 2-5% of a home’s purchase price and include fees for things like the appraisal, title insurance, and underwriting of your loan. To offset the cash you have to bring to the table, you can ask the seller to pay for some or all of these expenses. This was the most common concession sellers made in 2024, according to NAR.

- Home Warranties: If you’re worried about the maintenance costs that may pop up after you get the keys, you can ask the seller to pay for a home warranty. Since this concession usually isn’t terribly expensive for the seller, it can be a good negotiation tool for a buyer. It’s not a big cost for them, but it can be a big perk for you.

- Home Repairs: Based on the inspection, you’re within your rights to ask the seller to make repairs. If the seller doesn’t want to, they could offer to drop the home price or cover some closing costs, so you have more room in your budget to take care of the repairs yourself.

- Fixtures: Want that washer and dryer to stay? Maybe the stainless-steel fridge, too? In many cases, you can ask for appliances or even furniture to be included in the deal, which will save you money when you move in.

- Closing Date: The closing date is also negotiable. Based on your timeline, you may also request a faster or extended closing window. Depending on the seller’s needs, this could be great for their situation, too.

Of course, negotiating is a complex process. And not every seller will be willing to offer concessions. Again, lean on your agent for expert advice about what’s realistic to ask for and what could turn sellers off.

Because once you’ve found a home you love, you don’t want to risk losing it. But you also want to get the best terms possible on your purchase – and that’s where an agent can make all the difference.

Bottom Line

As inventory grows, buyers are finding they have a bit more leverage. And having the right agent by your side – who can help you approach negotiations strategically – is key.

What’s your biggest concern when it comes to negotiating with a seller?

Why Pre-Approval Is More Important Than Ever This Spring

Spring is here, and so is the busiest season in real estate. More buyers are out looking for homes, which means more competition for you. If you want to put yourself in the best position to buy, there’s one step you can’t afford to skip, and that’s getting pre-approved for a mortgage.

Some buyers think they can wait until they’ve found a home they love before talking to a lender. But in a season where homes can sell fast, that’s a risky move. Getting pre-approved before you start your search is a much better bet.

Here’s what you need to know about this early step in the buying process.

What Is Pre-Approval?

Pre-approval gives you a sense of how much a lender is willing to let you borrow for your home loan. To determine that number, a lender starts by looking at your financial history. Here are some of the things that can have an impact, according to Yahoo Finance:

- Your debt-to-income (DTI) ratio: This is how much money you owe divided by how much money you make. Usually, you can borrow more if you have a lower DTI.

- Your income and employment status: They’re looking to verify you have a steady income coming in – that way they feel confident in your ability to repay the loan.

- Your credit score: If your score is higher, you may qualify to borrow more.

- Your payment history: Do you consistently pay your bills on time? Lenders want to know you’re not a risky borrower.

After their review, you’ll get a pre-approval letter showing what you can borrow. Having this peace of mind is a big deal – it helps you feel a lot more confident in your ability to get a home loan. And the fringe benefit is it can also speed up the road to closing day because the lender will already have a lot of your information.

It Helps You Figure Out Your Budget

Spring is a competitive season, and emotions can run high if you find yourself up against other buyers. Having a firm budget in mind is so important. You don’t want to get too attached and end up maxing out what you can borrow. As Freddie Mac explains:

“Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

So, use this time to really buckle down on your numbers. And be sure to factor in other homeownership costs – like property taxes, insurance, and maybe even homeowner’s association fees – so you know what you can comfortably afford.

Then, partner with your agent to tailor your search to homes that match your budget. That way, you don’t fall in love with a house that’s out of your financial comfort zone.

It Helps Your Offer Stand Out During the Busy Season

Spring buyers aren’t just competing for homes. They’re competing for the seller’s attention, too. And a pre-approval letter can help you stand out by showing sellers you’ve already gone through a financial check. Zillow explains it like this:

“Having a pre-approval letter handy while you’re shopping for a home can also help you act quickly once you’ve found a home you love. The letter shows potential sellers that you’re a serious buyer who has the financial means to close on the home. In a competitive market, an offer with a pre-approval letter attached will stand out among other offers that don’t include one — increasing the chances of your offer being accepted.”

That means when sellers are choosing among multiple offers, yours could rise to the top simply because you’ve already taken this step.

And here’s one final tip for you. After you receive your letter, avoid switching jobs, applying for new credit cards or other loans, co-signing for loans, or moving money in or out of your savings. That’s because any changes to your finances can affect your pre-approval status.

Bottom Line

If you’re thinking about buying a home this spring, getting pre-approved should be your first move. It’ll help you understand your budget, show sellers you’re serious, and keep you from falling in love with a house that’s out of reach. Talk to a lender to get started.

What’s your plan to stand out in this competitive market? Connect with an agent to make sure you’re fully ready to buy.

The Best Week To List Your House Is Almost Here – Are You Ready?

If selling your house is on your to-do list this year, the time to start prepping is now. That’s because experts say the best week to list your house is coming up fast.

A recent Realtor.com study analyzed years of housing market trends (excluding 2020 since it was an outlier) and found that April 13–19 is expected to be the ideal window to put your house on the market this year:

“. . . we’ve identified April 13-19 as the best week to list for sellers . . . a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale.”

What Makes This Week Stand Out?

As the quote mentions, spring is almost always a strong season for sellers. But this particular week could give you an even bigger advantage this year. Realtor.com goes on to say what listing during this sweet spot could mean for you:

- More buyers looking at your home since demand is high this time of year.

- A faster sale since serious buyers are eager to move before summer.

- A better chance of selling for top dollar. According to the study, you could get an average of $4,800 more this week (and $27,000 more than you would earlier in the year).

If You Want Your House on the Market for that Window, Act Now

With just a few weeks left before this prime listing window, you’ll need to make a plan to work smart and act fast. That’s where working with a great real estate agent comes in. They can help you:

- Figure out exactly what you need to do to get your house ready.

- Prioritize the tasks that’ll make the biggest impact in the shortest time.

- Decide if there are any quick fixes or small upgrades that could help you attract buyers.

Assuming your house is already in good shape, your focus should be on quick, high-impact updates. As Investopedia explains:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Here are a few examples of small projects that can make a big difference according to Redfin:

What If You’re Not Ready Just Yet?

Don’t worry – it’s okay if you don’t think you’ll be ready for this week. Just because April 13–19 is projected to be the ideal week by Realtor.com, that doesn’t mean it’s the only good time to sell. Even if you need a bit more time to get your home list ready, there’s still plenty of opportunity this homebuying season.

Bottom Line

If you’ve been waiting for the right time to sell, this could be it. But timing isn’t the only thing that matters – how well you prep and price your home is just as important.

What’s one thing you’d need to do before you’d feel ready to list? Connect with an agent to figure out the best plan to make it happen.

4 Things To Expect from the Spring Housing Market

Spring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or sell, here’s the inside scoop on why this spring may be a great time to make your move.

1. There Are More Homes for Sale

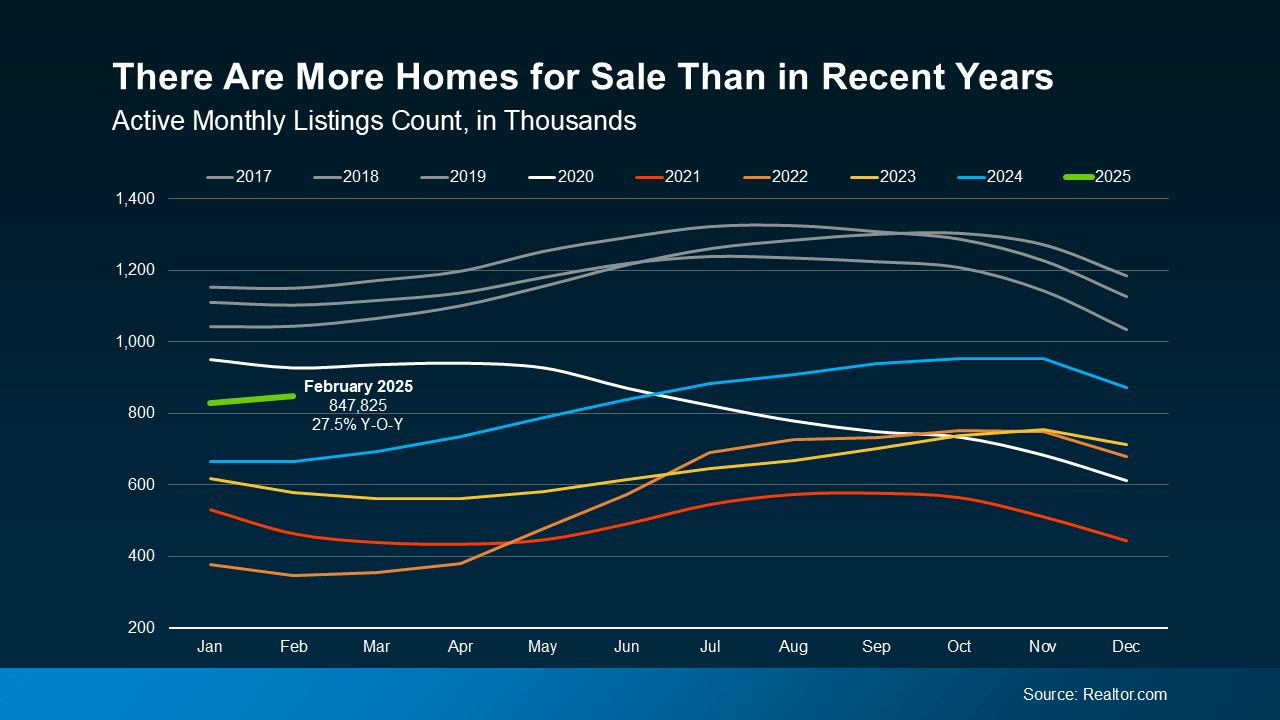

After a long stretch of tight inventory, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active listings are up 27.5% compared to this time last year.

Look at the graph below and follow the green line for 2025. You can see, even though inventory levels still haven’t returned to pre-pandemic norms (shown in gray), that number is higher than it has been going into the spring market over the past few years (see graph below):

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective.

Sellers: With more homes available than in recent years, you’re more likely to find what you’re looking for when you move. And knowing that inventory is still below more normal levels means there will be demand for your home when you sell it, too.

2. Home Price Growth Is Moderating

As inventory grows, the pace of home price growth is slowing down – and that will continue into the spring market. This is because prices are driven by supply and demand. When there are more homes for sale, buyers have more options, so there’s less competition for each house. Rising supply and less buyer competition causes price growth to slow, but it should still remain positive in most markets. As Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

And while prices aren’t dropping at the national level, every market is different. Some areas are seeing stronger price growth, while others are cooling off or even seeing some price declines.

Buyers: The slower pace of growth means prices aren’t rising as quickly as before – and that’s a relief. Any home you buy now is likely to appreciate in value over time, helping you build equity.

Sellers: While prices are still rising, you might need to adjust your expectations. Overpricing your house in a more balanced market could mean it takes longer to sell. Pricing your house competitively is going to be key to attracting offers.

3. Mortgage Rates Are Stabilizing

One of the biggest hurdles for buyers over the past couple of years has been high, volatile mortgage rates. But there’s some good news – overall, they’ve stabilized in recent weeks – and have even declined a bit since the beginning of this year. And while that decrease hasn’t been a big drop, stabilizing mortgage rates has helped make buying a home a bit more predictable. According to Selma Hepp, Chief Economist at CoreLogic:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

Buyers: When mortgage rates are more stable, it’s easier to plan ahead because you have a better idea of what your future payment might be. But remember, rates will continue to be volatile. So, lean on your agent and your lender to make sure you know what the latest mortgage rate means for you.

Sellers: Slightly lower rates that are starting to stabilize are encouraging more buyers to move forward with their plans. That’s good for demand when you’re planning to sell your house.

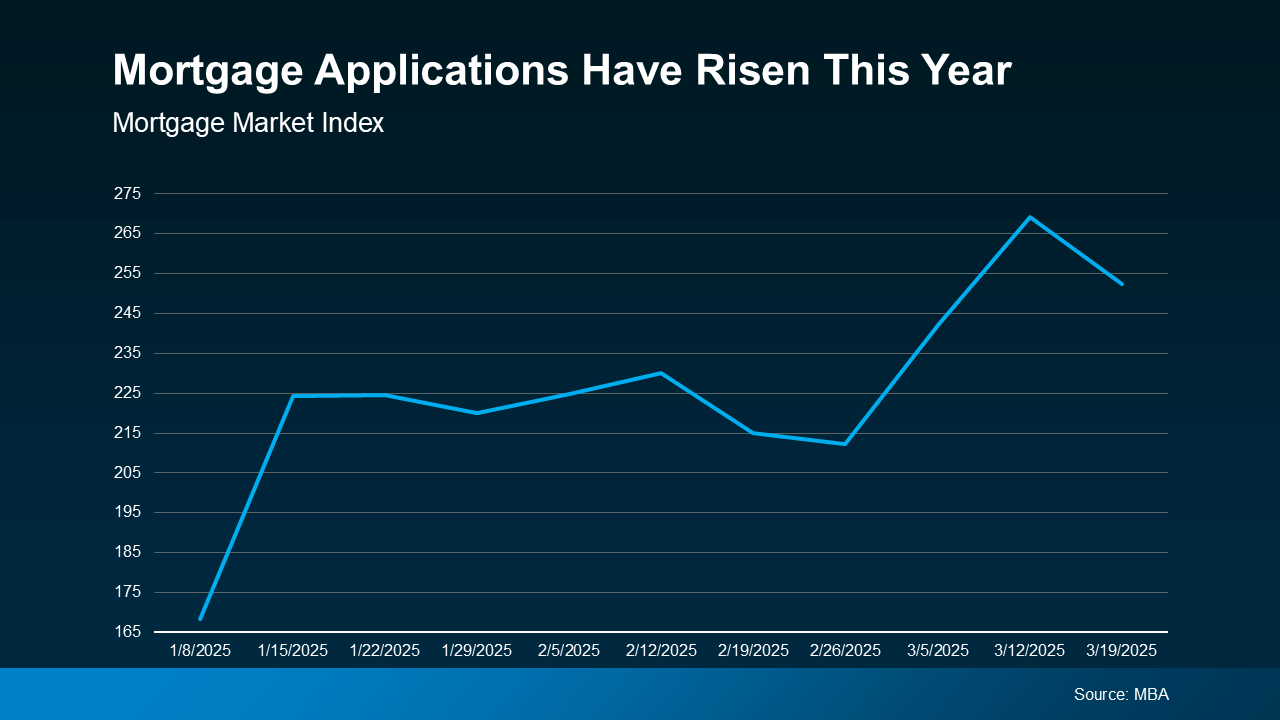

4. More Buyers Are Returning

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market. Demand is picking up, and data from the Mortgage Bankers Association (MBA) shows an increase in mortgage applications compared to the start of the year (see graph below):

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Sellers: This is great news for you – more buyers mean a better chance of selling your house quickly.

Bottom Line

Do you have questions about what the spring market means for you? Connect with a local real estate agent and talk about how to craft your plan this season.

With more homes for sale, slowing price growth, and stabilizing mortgage rates, how will this impact your decision to buy or sell this spring?

Your Roadmap to Homeownership

Some Highlights

- Buying a home isn’t just a transaction – it’s a journey. And like any great adventure, having a solid roadmap makes all the difference.

- From building your dream team to getting pre-approved, house hunting, and signing the papers on closing day – each milestone is an achievement.

- Your journey starts here. Connect with an agent so you have help every step along the way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link