What an Economic Slowdown Could Mean for the Housing Market

Talk about the economy is all over the news, and the odds of a recession are rising this year. That’s leaving a lot of people wondering what it means for the value of their home – and their buying power.

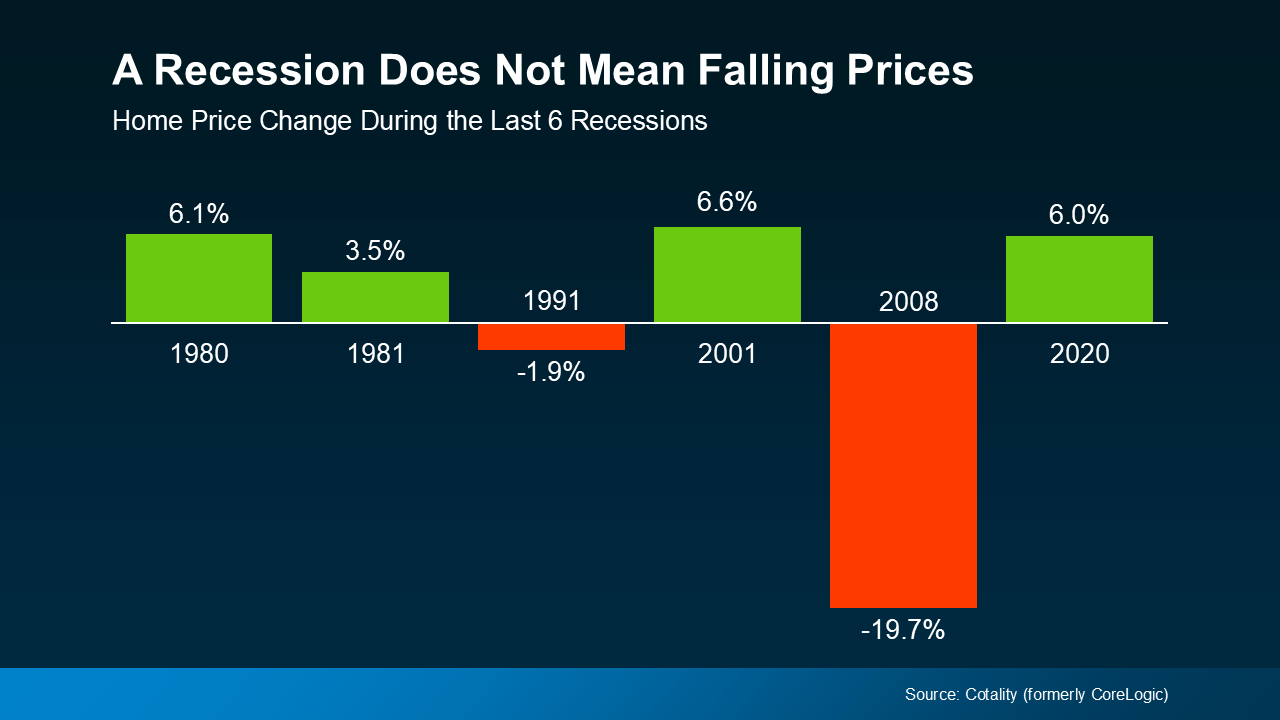

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s. The facts may surprise you.

A Recession Doesn’t Mean Home Prices Will Fall

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because inventory is still so low overall. Even in markets where the number of homes for sale has started to rise this year, inventory is still far below the oversupply of homes that led up to the housing crash.

In fact, according to data from Cotality (formerly CoreLogic), in four of the last six recessions, home prices actually went up (see graph below)

So, don’t assume a recession will lead to a significant drop in home values. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising, just at a more normal pace.

So, don’t assume a recession will lead to a significant drop in home values. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising, just at a more normal pace.

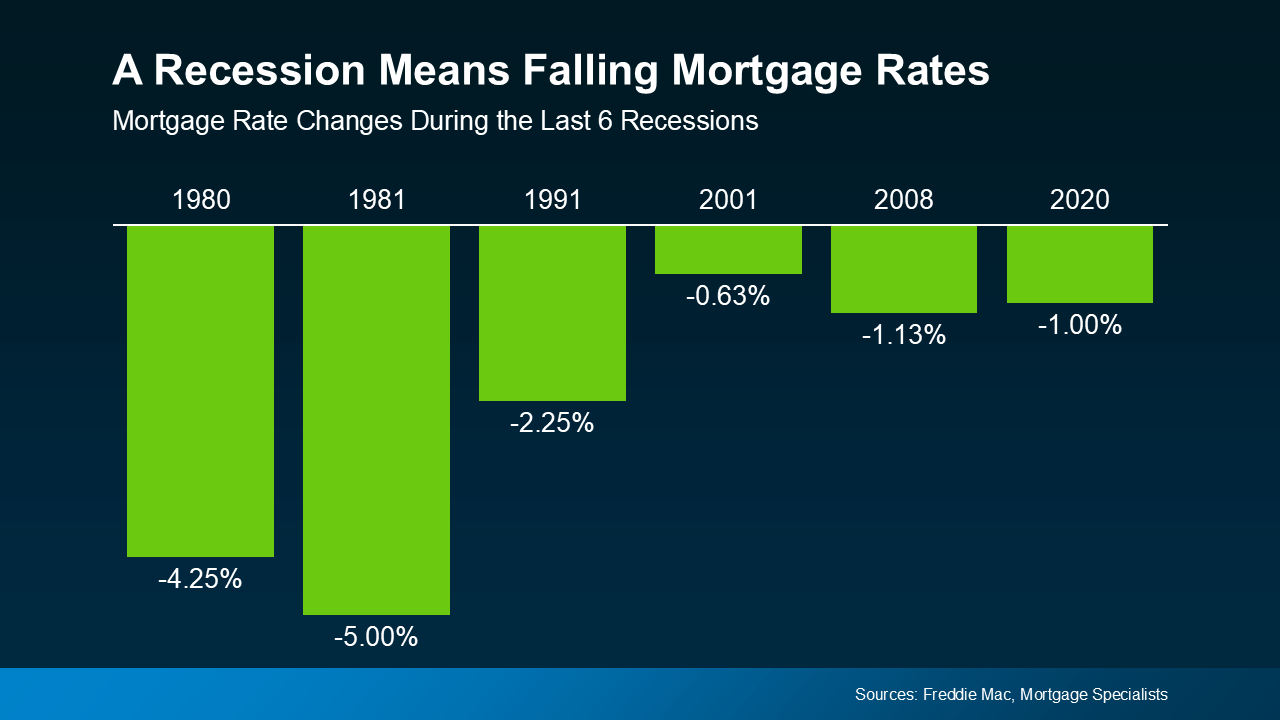

Mortgage Rates Typically Decline During Recessions

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means rates could decline. And while that would help with your buying power, don’t expect the return of a 3% rate.

So, a recession means rates could decline. And while that would help with your buying power, don’t expect the return of a 3% rate.

Bottom Line

The answer to the recession question is still unknown, but the odds have gone up. However, that doesn’t mean you have to worry about what it means for the housing market – or the value of your home. Historical data tells us what usually happens.

If you’re wondering how the current economy is impacting your local market, connect with an agent.

A Tale of Two Housing Markets

For a long time, the housing market was all sunshine for sellers. Homes were flying off the shelves, and buyers had to compete like crazy. But lately, things are starting to shift. Some areas are still super competitive for buyers, while others are seeing more homes sit on the market, giving buyers a bit more breathing room.

In other words, it’s a tale of two markets, and knowing which one you’re in makes a huge difference when you move.

What Is a Buyer’s Market vs. a Seller’s Market?

In a buyer’s market, there are a lot of homes for sale, and not as many people buying. With fewer buyers competing for these homes, that means they generally sit on the market longer, they might not sell for as much as they would in a seller’s market, and buyers have more room to negotiate.

On the flip side, in a seller’s market, there aren’t enough homes for sale for the number of buyers who are trying to purchase them. Homes sell faster, sellers often get multiple offers, and prices shoot higher because buyers are willing to pay more to win the home.

The Market Is Starting To Balance Out

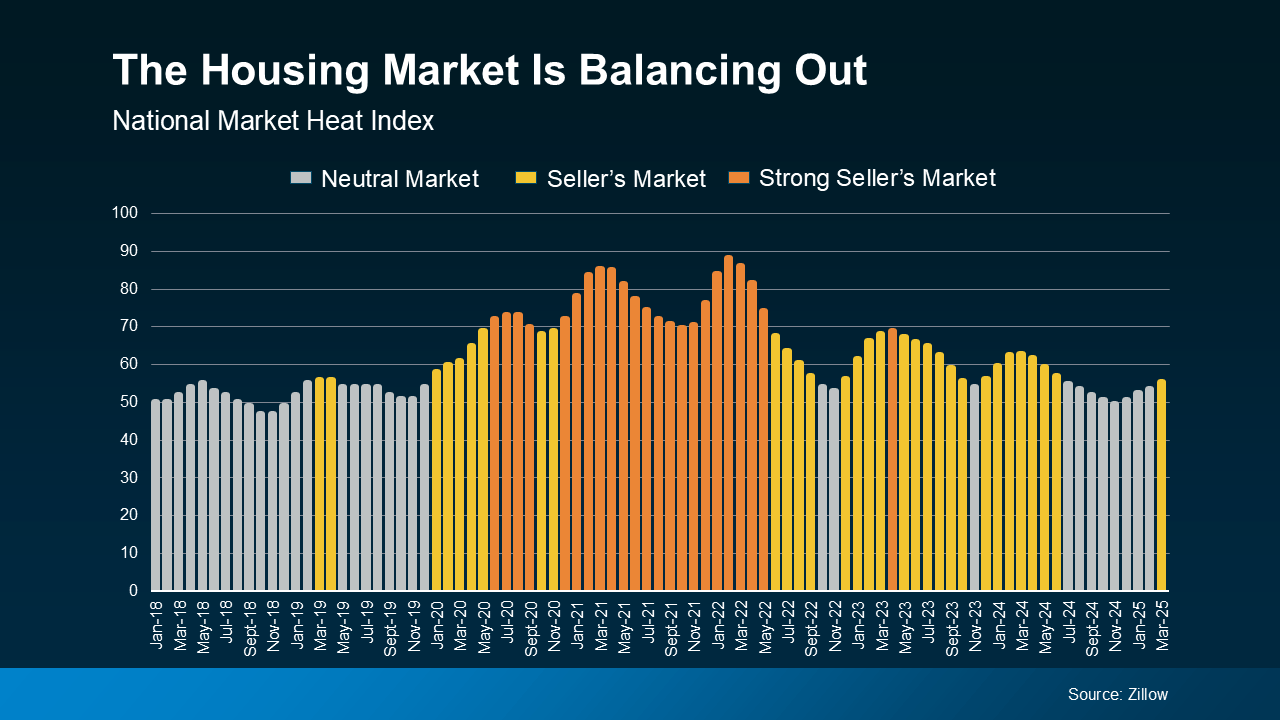

For years, almost every market in the country was a strong seller’s market. That made it tough for buyers – especially first-timers. But now, things are shifting. According to Zillow, the national housing market is balancing out (see graph below):

The index used in this graph measures whether the national housing market is more of a seller’s market, buyer’s market, or neutral market – basically, whether it favors buyers, sellers, or if it’s not really swinging either way. Each month, the market is measured between 0 and 100. The closer to 100, the bigger the advantage sellers have.

The index used in this graph measures whether the national housing market is more of a seller’s market, buyer’s market, or neutral market – basically, whether it favors buyers, sellers, or if it’s not really swinging either way. Each month, the market is measured between 0 and 100. The closer to 100, the bigger the advantage sellers have.

The orange bars in the middle of the graph show the years when sellers had their strongest advantage, from 2020 to early 2022. But, as time has gone on, the market has become more balanced. It shifted from a strong seller’s market to a less intense one. And lately, it’s been neutral more than anything else (that’s the gray bars on the right side of the graph). That means buyers are gaining some negotiating power again.

In a more balanced or neutral market, homes tend to stay on the market a little longer, bidding wars are less common, and sellers may need to make more concessions – like price reductions or helping with closing costs. That shift gives today’s buyers more opportunities and less competition than a couple of years ago.

Why Are Things Changing?

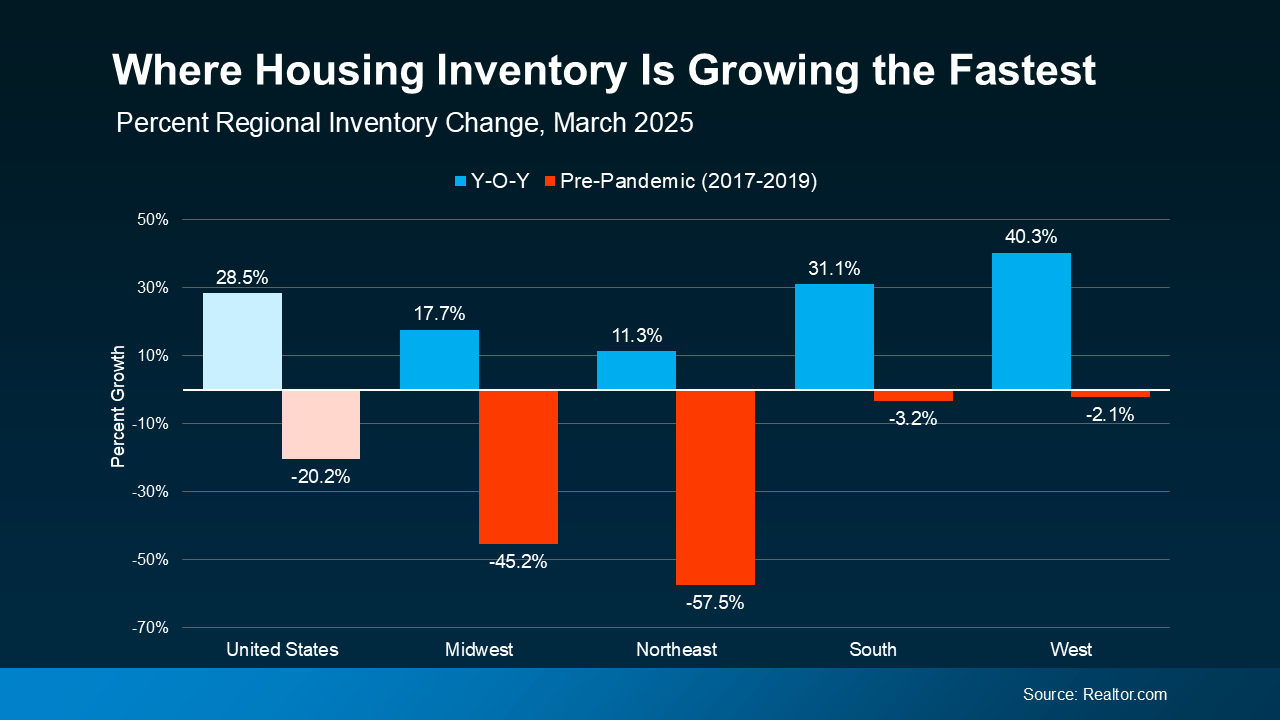

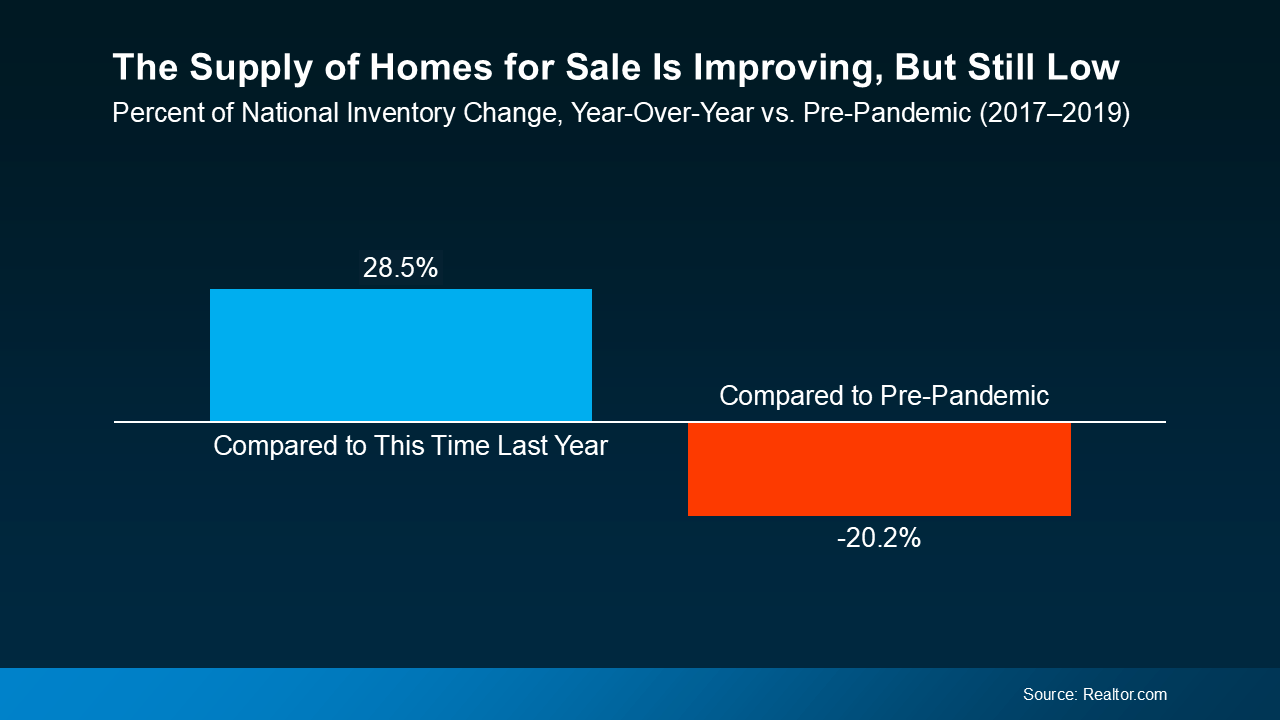

Inventory plays a big role. When there are more homes for sale, buyers have more options – and that cools down home price growth. As data from Realtor.com shows, the supply of available homes for sale isn’t growing at the same rate everywhere (see graph below):

This graph shows how inventory has changed compared to last year (blue bars) and compared to 2017–2019 (red bars) in different regions of the country.

This graph shows how inventory has changed compared to last year (blue bars) and compared to 2017–2019 (red bars) in different regions of the country.

The South and West regions of the U.S. have seen big jumps in housing inventory in the past year (that’s the blue on the right). Both are almost back to pre-pandemic levels. That’s why more buyer’s markets are popping up there.

But in the Northeast and Midwest, inventory is still very low compared to pre-pandemic (that’s why those red bars are so big). That means those areas are more likely to stay seller’s markets for now.

What This Means for You

Every local market is different. Even if the national headlines say one thing, your town (or even your neighborhood) could be telling a totally different story.

Knowing which type of market you’re in helps you make smarter decisions for your move. That’s why working with a local real estate agent is so important right now.

As Zillow says:

“Agents are experts on their local markets and can craft buying or selling strategies tailored to local market conditions.”

Agents understand the unique trends in your area and can help you make the best choices, whether you’re buying or selling. With their expert strategies, you can move no matter which way the market is leaning, because they know how to navigate various levels of buyer competition, how to find hidden gems locally, how to price a house right, how to negotiate based on who has more leverage, and more.

Bottom Line

If you’re ready to make a move, or even just thinking about it, connect with a local real estate agent. They’d love to help you understand your local market and create a game plan that works for you.

What’s one thing you’re curious about when it comes to the market in your area?

Why Today’s Foreclosure Numbers Aren’t a Warning Sign

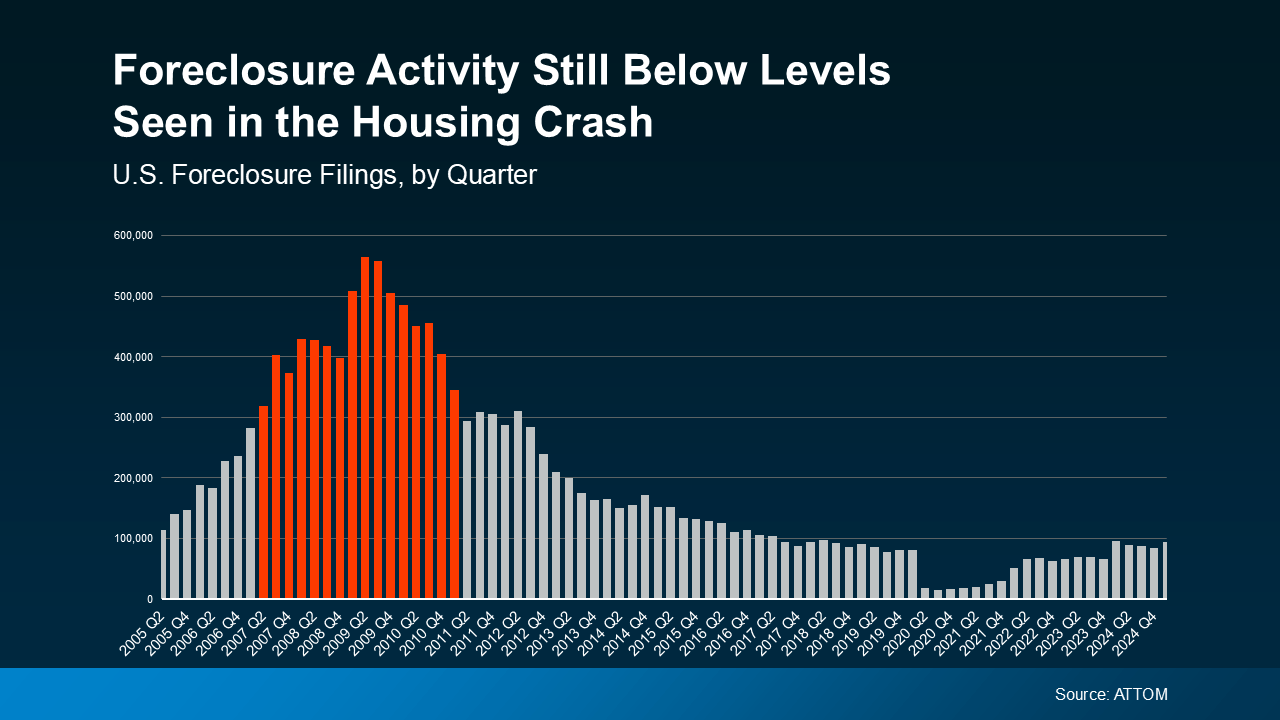

When it feels like the cost of just about everything is rising, it’s only natural to wonder what that means for the housing market. Some people are even questioning whether more homeowners will struggle to make their mortgage payments, ultimately leading to a wave of foreclosures. And recent data showing foreclosure filings have increased is only feeding into this fear. But don’t let that scare you.

If you put the latest data into context, it’s clear there’s no reason to think this is a repeat of the last housing crash.

This Isn’t Like 2008

While it’s true that foreclosure filings ticked up in the latest quarterly report from ATTOM, they’re still lower than the norm – and way below levels seen during the crash. And it’s a lot easier to see if you graph that out.

If you compare Q1 2025 (on the right side of the graph) to what happened in the years surrounding the 2008 crash (shown in red), it’s clear the market is in a completely different place (see graph below):

Back then, risky lending practices left homeowners with mortgages they couldn’t afford. That led to a wave of foreclosures, which flooded the market with distressed properties, a surplus of inventory, and caused home prices to drop dramatically.

Back then, risky lending practices left homeowners with mortgages they couldn’t afford. That led to a wave of foreclosures, which flooded the market with distressed properties, a surplus of inventory, and caused home prices to drop dramatically.

Today, lending standards are much stronger, and most homeowners are in a much better financial position. That’s why filings are so much lower this time.

And just in case you’re looking at 2020 and 2021 and thinking we’ve ramped up since then, here’s what you need to know. During those years, there was a moratorium designed to help millions of homeowners avoid foreclosure in challenging times. That’s why the numbers for just a few years ago were so incredibly low.

So don’t compare today to that low point. If you look at more normal years like 2017-2019, overall foreclosure filings are actually down from what’s typical – and way down from the volume during the crash.

Of course, no one wants to go through the process of foreclosure. And the recent increase is emotional because it’s real lives that are impacted – let’s not discount that. It’s just that, as a whole, this isn’t a signal of trouble in the market.

Why We Haven’t Seen a Big Surge in Foreclosures

And here’s something else to reassure you: homeowner equity. Over the past few years, home prices have risen significantly. That means today’s homeowners have built up a solid financial cushion. As Rob Barber, CEO at ATTOM, explains:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . .”

Basically, if someone falls on hard times and can’t make their mortgage payments, they may be able to sell their home instead of going into foreclosure. That’s a huge contrast to 2008, when many people owed more than their homes were worth and had no choice but to walk away.

Don’t discount the strong equity footing most homeowners have today. As Rick Sharga Founder and CEO of CJ Patrick Company, explains in a recent Forbes article:

“ . . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Bottom Line

Even with the recent increase, foreclosure numbers are not at the levels seen during the 2008 crash. Plus, most homeowners today are in a much stronger equity position, even with rising costs.

If you are a homeowner who’s facing hardship, talk to your mortgage provider to explore your options.

Paused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

It’s not really a surprise that 70% of buyers paused their home search last year. Maybe you were one of them. And if so, no judgment. Conditions just weren’t great.

Inventory was too low, prices were too high, and mortgage rates were bouncing all over. That made it really hard to find a home you loved – and could afford. And why sell if you’re not sure where you’re going to go?

But here’s the thing: the market’s shifting. And it might be time to hit play again.

The Inventory Sweet Spot

More homeowners are jumping back into their search to make a move this year. Builders are finishing more homes. And together, that’s creating more options for you when you move – maybe even the home you’ve been waiting for.

More homes = more possibilities.

But there’s more to it than that. When you sell, you don’t want to feel like it’s impossible to find your next home. At the same time, you also don’t want inventory to be so high, it takes ages for your house to sell. Right now, you’ll get the best of both worlds.

This data will help paint the picture for you. According to Realtor.com, inventory has jumped 28.5% since this time last year, but it’s still below pre-pandemic levels in most markets – and here’s why this is such a sweet spot (see graph below):

Basically, there are more homes to choose from when you make your move, but not so many that you’ll struggle to sell your current house. Your home should sell quickly if you work with an agent to make sure it’s priced right and prepped to impress.

Basically, there are more homes to choose from when you make your move, but not so many that you’ll struggle to sell your current house. Your home should sell quickly if you work with an agent to make sure it’s priced right and prepped to impress.

More options. Less chaos. Solid demand: That’s the real sweet spot.

But here’s something else to consider. Data from Realtor.com also shows inventory has been on the rise for 17 straight months. And experts agree it’s likely to continue climbing throughout the year. As Lance Lambert, Co-Founder of ResiClub explains:

“The fact that inventory is rising year-over-year . . . strongly suggests that national active housing inventory for sale is likely to end the year higher.”

So, this may actually be the best time to sell. Your house may stand out more now than it would as the year goes on and inventory grows even more. Wait too long, and you may be one of many trying to stand out later this year.

Bottom Line

If you’ve been waiting for the housing market to give you a sign – it just did. Whether you’re looking to move up, scale down, or relocate completely, this might be the best balance we’ve seen in a while.

What’s holding you back from taking advantage of this sweet spot? Connect with an agent to talk through it and see what’s possible.

You Finally Have More Options for Your Move

Some Highlights

- If you put your home search on hold because you couldn’t find anything you liked in your budget, it’s time to try again.

- There’s a much wider selection of homes for sale, with more fresh listings hitting the market each month.

- With more options come more possibilities. Connect with an agent if you want to see what’s available in your area.

Should I Buy a Home Now or Wait?

At some point, you’ve probably heard the saying: “Yesterday was the best time to buy a home, but the next best time is today.”

That’s because homeownership is about the long game – and home prices typically rise over time. So, while you may be holding out for prices to fall or rates to improve, you should know that trying to time the market rarely works.

Here’s what most buyers don’t always think about: the longer you wait, the more buying could cost you. And you deserve to understand why.

Forecasts Say Prices Will Keep Climbing

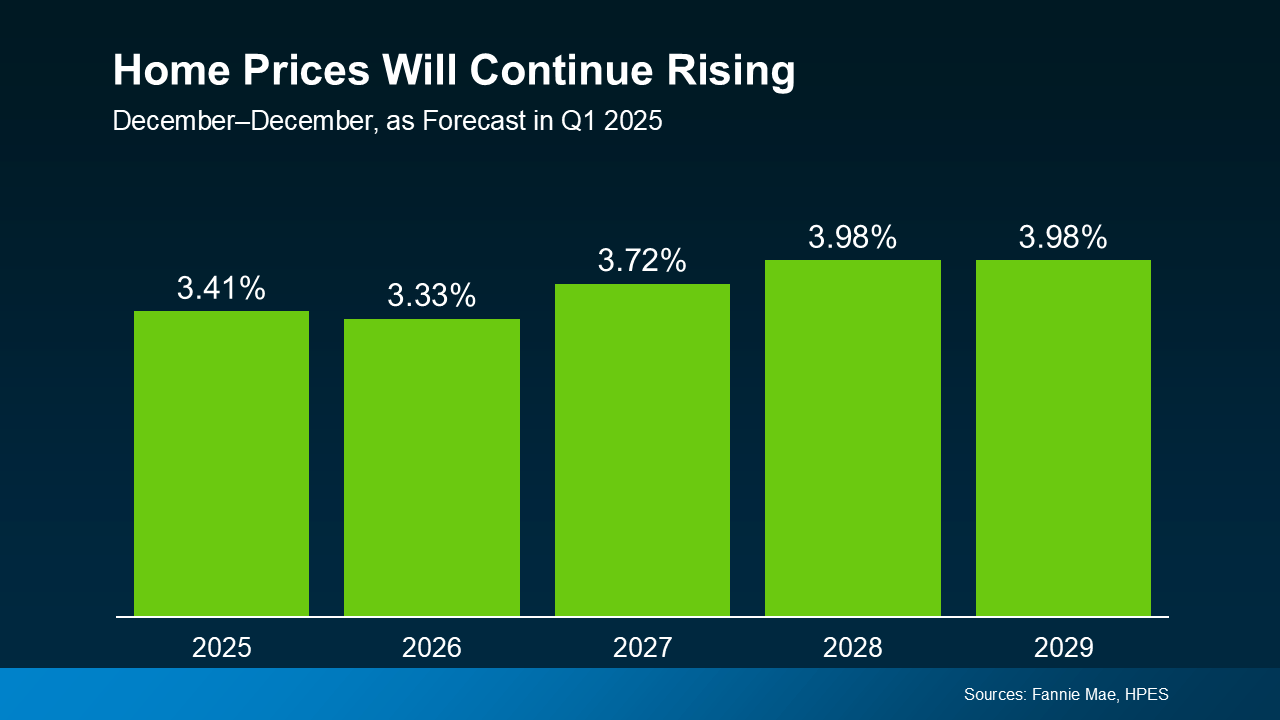

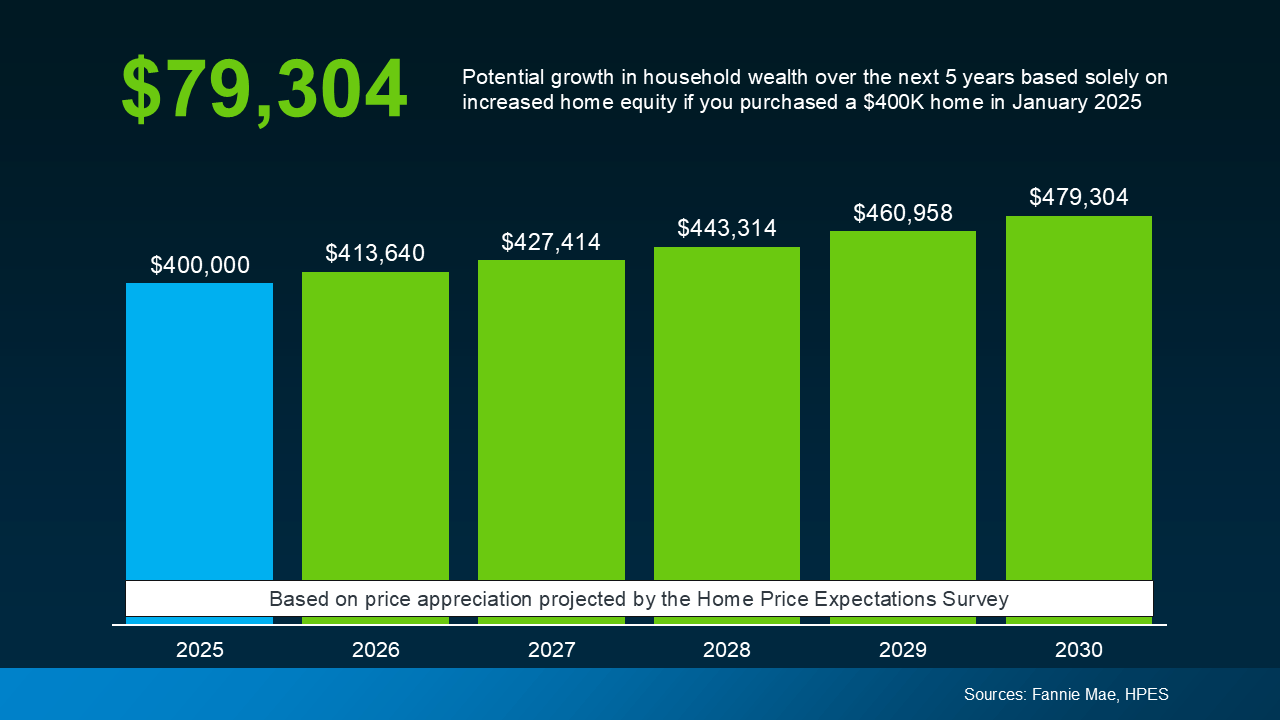

Each quarter, over 100 housing market experts weigh in for the Home Price Expectations Survey from Fannie Mae, and they consistently agree on one thing: nationally, home prices are expected to rise through at least 2029.

Yes, the sharp price increases are behind us, but experts project a steady, healthy, and sustainable increase of 3-4% per year going forward. And while this will vary by local market from year to year, the good news is, this is a much more normal pace – a welcome sign for the housing market and hopeful buyers (see graph below):

And even in markets experiencing more modest price growth or slight short-term declines, the long game of homeownership wins over time.

So, here’s what to keep in mind:

- Next year’s home prices will be higher than this year’s. The longer you wait, the more the purchase price will go up.

- Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, projected home price growth could still make waiting more expensive overall.

- Buying now means building equity sooner. When you play the long game of homeownership, your equity rewards you over time.

What You’ll Miss Out On

Let’s put real numbers into this equation, because it adds up quickly. Based on those expert projections, if you bought a typical $400,000 home in 2025, it could gain nearly $80,000 in value by 2030 (see graph below):

That’s a serious boost to your future wealth – and why your friends and family who already bought a home are so glad they did. Time in the market matters.

That’s a serious boost to your future wealth – and why your friends and family who already bought a home are so glad they did. Time in the market matters.

So, the question isn’t: should I wait? It’s really: can I afford to buy now? Because if you can stretch a little or you’re willing to buy something a bit smaller just to get your foot in the door, this is why it’ll be worth it.

Yes, today’s housing market has challenges, but there are ways to make it work, like exploring different neighborhoods, asking your lender about alternative financing, or tapping into down payment assistance programs.

The key is making a move when it makes sense for you, rather than waiting for a perfect scenario that may never arrive.

Bottom Line

Time in the Market Beats Timing the Market.

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Want to take a look at what’s happening with prices in your local area? Whether you’re ready to buy now or just exploring your options, having a plan in place can set you up for long-term success.

What’s Your House Worth Now? The Answer May Surprise You

Let’s talk about something you might not check nearly as often as your bank account – and that’s how much your home is worth. But when it comes to your financial situation, it’s an important thing to remember. When’s the last time you had a professional show you the value of your home?

Think about it. For most people, your house is probably the biggest asset you have. And if you’ve owned your home for a few years (or longer), chances are it’s been quietly building wealth for you in the background. And honestly? You might be surprised by just how much.

What Is Home Equity?

This wealth you may not even realize you have comes in the form of home equity. Home equity is the difference between what your house is worth and what you still owe on your mortgage. It grows over time as home values rise and as you pay down your mortgage each month. Here’s an example to help you really understand how this works.

Let’s say your house is now worth $500,000, and you have $200,000 left to pay off on your loan. That means you have $300,000 in equity. And most homeowners are sitting on some pretty significant equity right now.

According to Cotality (formerly CoreLogic), the average homeowner with a mortgage has about $311,000 in equity.

Why You Probably Have More Than You Think

Here are the two main reasons homeowners like you have record amounts of equity right now:

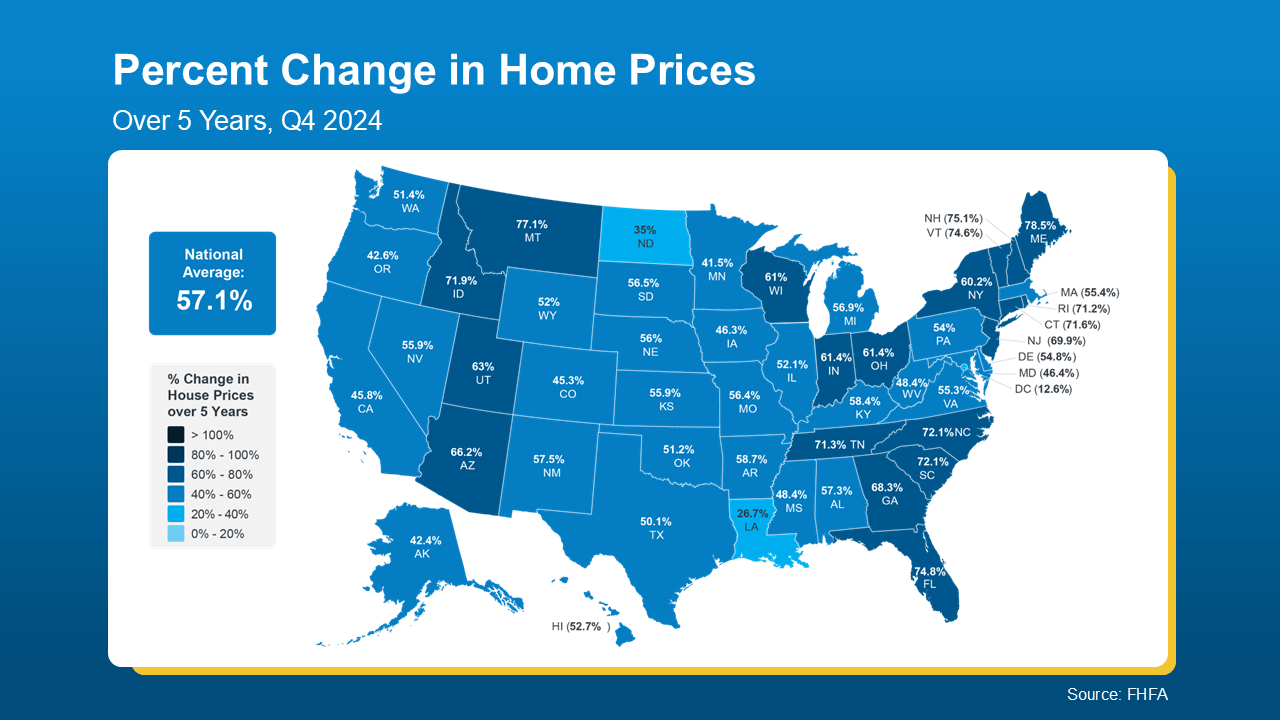

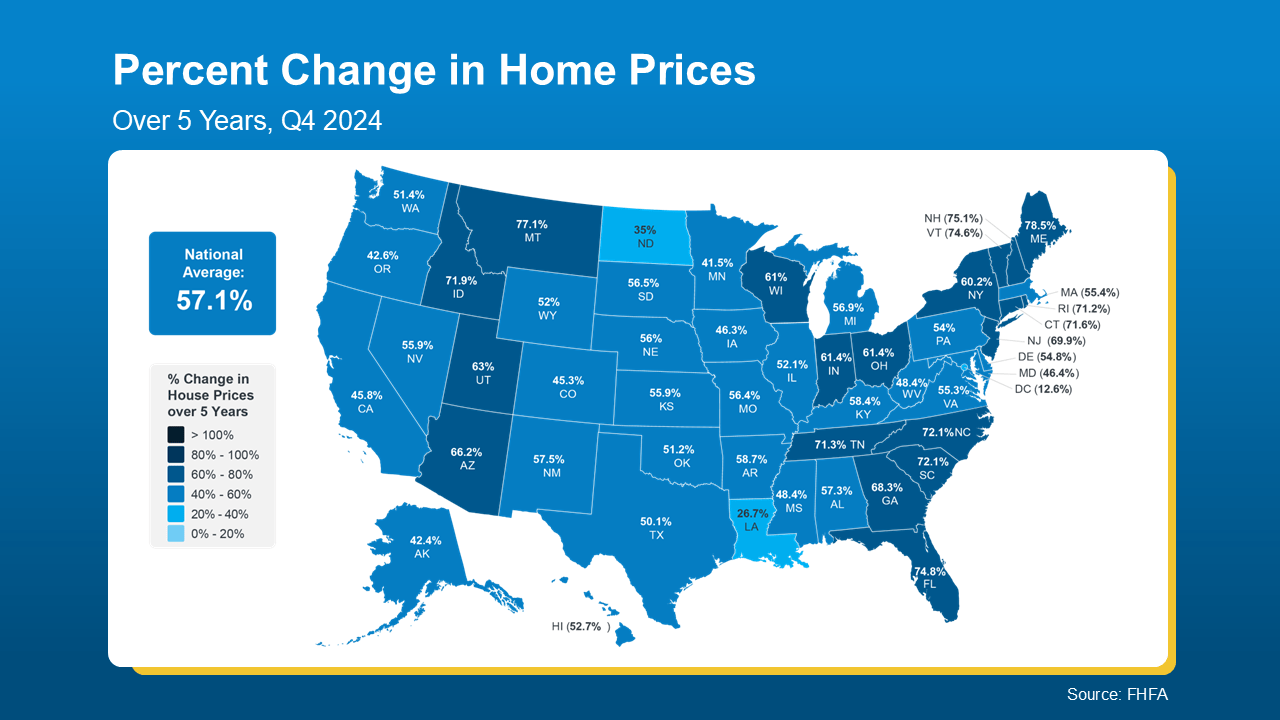

1. Significant Home Price Growth. According to the Federal Housing Finance Agency (FHFA), home prices have jumped by more than 57% nationwide over the last five years (see map below):

And if you purchased your home a few years ago (or more), this means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed lately.

And if you purchased your home a few years ago (or more), this means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed lately.

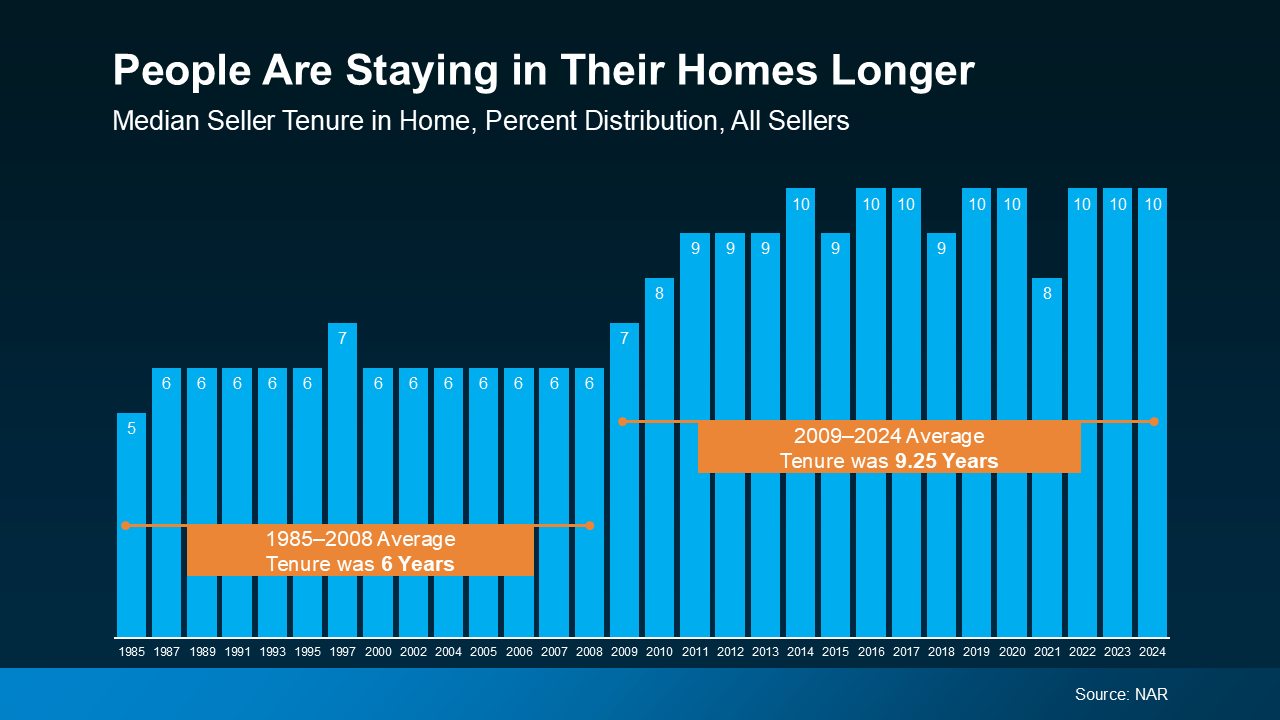

2. People Are Living in Their Homes Longer. Data from the National Association of Realtors (NAR), shows the average homeowner stays in their home for about 10 years now (see graph below):

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values.

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values.

So, if you’re one of those people who’s been in their home for that long, here’s how much the behind-the-scenes price growth has helped you out. According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What Could You Actually Do with That Equity?

Remember, your house might be your biggest financial asset – and, if you’re smart about how you leverage your equity, it could open up some exciting opportunities for your future.

- Use it to help buy your next home. Your equity could help you cover the down payment on your next home. In some cases, it might even mean you can buy your next house in all cash.

- Renovate your current house to better suit your life now. And, if you’re strategic about your projects, they could add even more value to your home if you do sell later on.

- Start the business you’ve always dreamed of. Your equity could be exactly what you need for startup costs, equipment, or marketing. And that could help increase your earning potential, so you’re getting yet another financial boost.

Bottom Line

Chances are, your house is worth a lot more than you realize. Whether you’re thinking about selling, upgrading, or simply want to understand your options, your equity isn’t just a number. It’s a tool.

If you sold your house and had significant equity to work with, what would you do with it? Connect with an agent to figure out how to turn your home’s value into your next big move.

What You Can Do When Mortgage Rates Are a Moving Target

Have you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home.

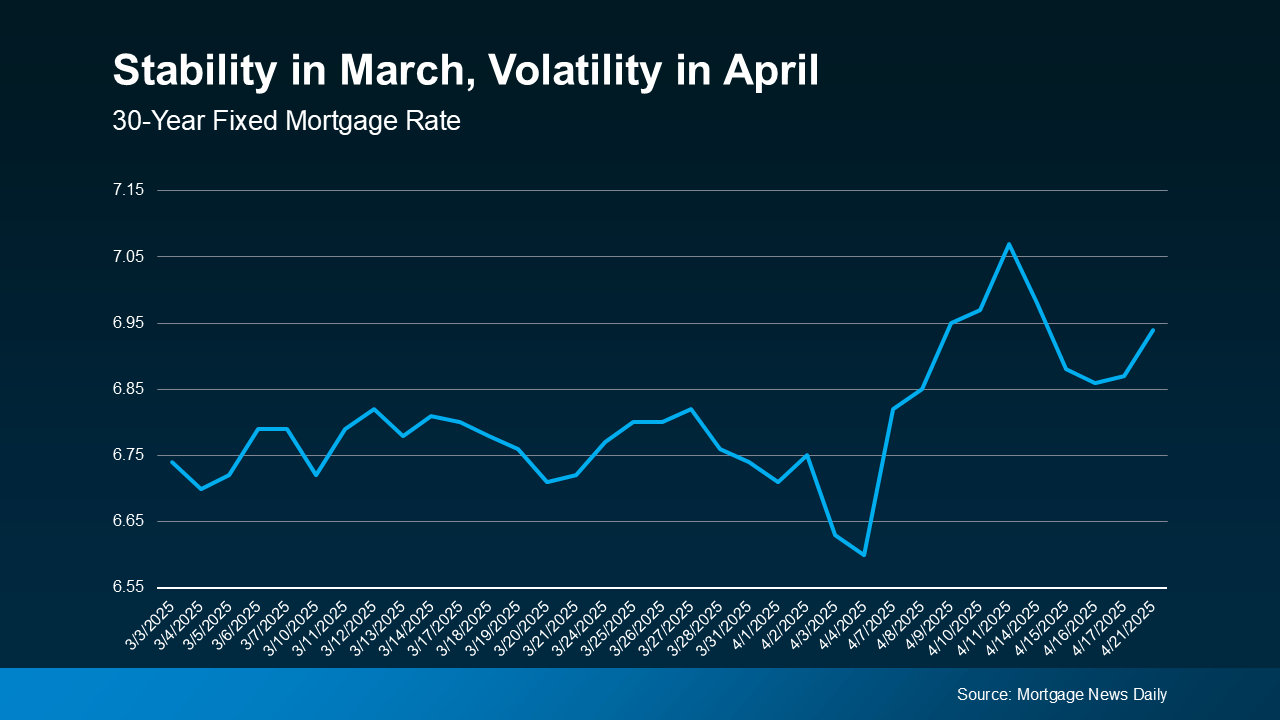

Take a look at the graph below. It uses data from Mortgage News Daily to show that after a relatively stable month of March, mortgage rates have been on a bit of a roller coaster ride in April:

This kind of up-and-down volatility is expected when economic changes are happening.

This kind of up-and-down volatility is expected when economic changes are happening.

And that’s one of the reasons why trying to time the market isn’t your best move. You can’t control what happens with mortgage rates. But you’re not powerless. Even with all the economic uncertainty right now, there are things you can do.

You can control your credit score, loan type, and loan term. That way, you can get the best rate possible in today’s market.

Your Credit Score

Your credit score can really affect the mortgage rate you qualify for. Even a small change in your score can make a big difference in your monthly payment. Like Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

Keeping your credit score up is key when it comes to qualifying for a home loan. If you’re not sure where your score stands or how to improve it, talk to a loan officer you trust.

Your Loan Type

There are also different types of loans out there, and each one comes with unique requirements for qualified buyers. The Consumer Financial Protection Bureau (CFPB) explains:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Always work with a mortgage professional to figure out which loan makes the most sense for you and your financial situation.

Your Loan Term

Just like there are different loan types, there are also different loan terms. Freddie Mac puts it like this:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Most lenders typically offer 15, 20, or 30-year conventional loans. Be sure to ask your loan officer what’s best for you.

Bottom Line

You can’t control what’s happening with the economy or mortgage rates, but you can take steps that’ll help you get the best rate possible.

Connect with a local real estate agent and a lender to talk about what you can do today to put yourself in a strong spot for when you’re ready to buy a home.

Don’t Miss This Prime Spring Window To Sell Your House

According to Realtor.com, the best week to list your house this year was April 13–19. And since that week has come and gone, you might be wondering: did I miss my chance? Not at all – and here’s why.

That’s just one source’s take, based on their own research. Other organizations run similar studies. And since different places use different methodologies for their research, sometimes the results vary too – and that’s actually good news for you. According to Zillow, the best time to list your house is still ahead.

The latest research from Zillow says sellers who list their homes in late May tend to see higher sale prices based on home sales from last year. The study explains why:

“Search activity typically peaks before Memorial Day, as shoppers get serious about house hunting before their summer vacation and the new school year in the fall. By targeting late spring, sellers can get their home listed when the most shoppers are looking. When more buyers are competing for homes, sellers can command a higher price.”

And they’re not the only ones saying selling in May can help homeowners net top dollar. ATTOM Data conducted a similar study by analyzing 59 million home sales over the past 13 years:

“Freshly compiled sales statistics from ATTOM demonstrate that home sellers continue to reap significant benefits from listing their properties during the month of May. Examination of home sales trends spanning thirteen years reveals that, on average, sellers are commanding 11.1 percent premium above the estimated market value.”

An article from Bankrate echoes this sentiment and brings this all together to show that any time in April or May is a good time:

“Some patterns and trends usually do hold true throughout the year, and one is that spring continues to be the best time to sell. Sellers can net thousands of dollars more if they sell during the peak months of April and May. . .”

The window to sell during prime time is very much still open, so you can make a move and potentially cash in big if you sell now.

That said, the best week to list your house really depends on a few local factors, like buyer demand, how many homes are for sale nearby, and how quickly things are selling. That’s why working with an experienced agent who knows your area is key.

Bottom Line

Spring is the busiest time in real estate – and there’s still time to take full advantage of that momentum.

What’s holding you back from making your move this spring? And what would help you feel ready? Connect with an agent to talk about it.

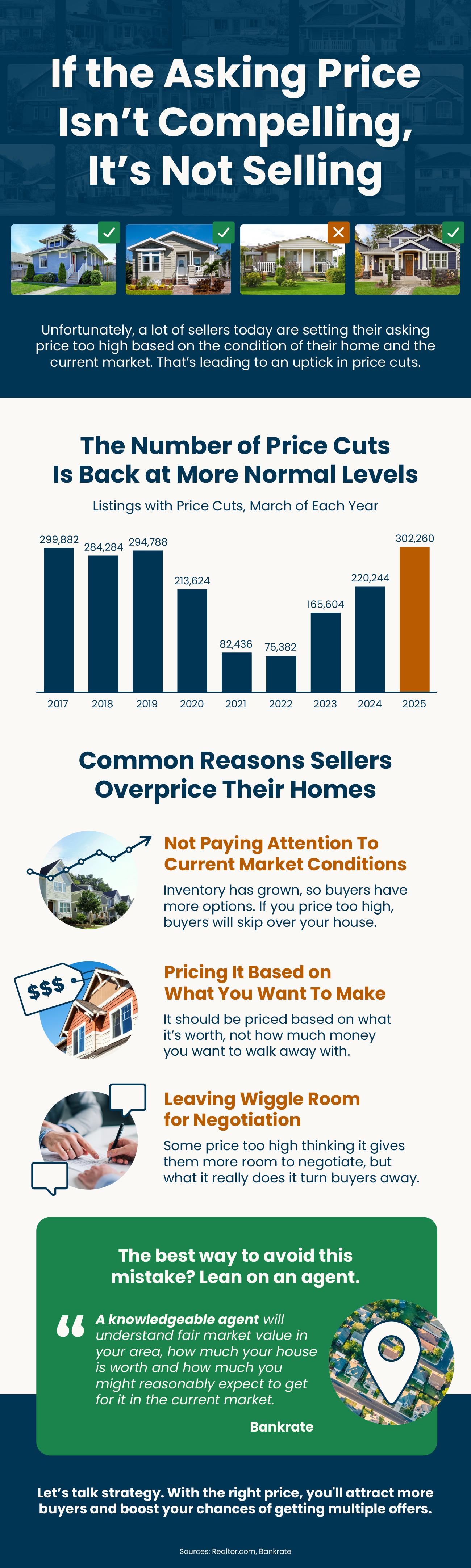

If the Asking Price Isn’t Compelling, It’s Not Selling

Some Highlights

- Unfortunately, a lot of sellers today are setting their asking price too high. That’s leading to an uptick in price cuts.

- Some of the most common reasons this is happening are that they’re not paying attention to current market conditions or they’re trying to leave room for negotiation.

- The best way to avoid this mistake? Connect with an agent to make sure your house is priced to pull people in, not push them away.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link